IG Group makes editing of positions more convenient in updated mobile app

The latest version of IG Trading’s app for iPhone and iPad provides traders with the ability to edit numerous positions at once.

IG Group Holdings plc (LON:IGG) has recently unveiled its upgraded web trading platform, with the mobile applications not lagging behind the innovation drive that has apparently engulfed the company.

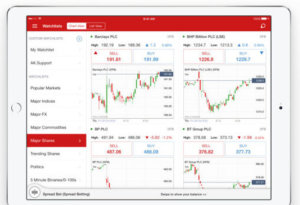

The latest version of the mobile application IG Trading for iPhone and iPad is also enjoying some new useful additions, with the focus on those active users of the solutions who open and monitor several positions simultaneously. The most recent version of the app enables editing of multiple positions at once in aggregate mode.

The latest version of the mobile application IG Trading for iPhone and iPad is also enjoying some new useful additions, with the focus on those active users of the solutions who open and monitor several positions simultaneously. The most recent version of the app enables editing of multiple positions at once in aggregate mode.

The IG Trading app provides traders access to thousands of markets including Forex, shares, indices and commodities. Thanks to a large variety of features such as sophisticated charts, news and alerts, as well as analysis tools, traders can identify opportunities.

One of the most significant upgrades that the IG trading app has ever undergone is probably when it became available on Apple Watch back in April 2015. With that move, IG Group reiterated its position as a tech-savvy company. The app version for Apple Watch enables users to buy and sell stocks, trade CFDs and spread bet across a number of asset classes from the watch and monitor their existing positions.

Talking of IG platforms, we should note the latest novelties on the company’s web trading platform IG Trading. Last week, FinanceFeeds reported that the company is working to add a set of new features to the platform, including a ProRealTime button. The IG team has just announced that the functionality is already available and that now, thanks to this dedicated button, traders can launch ProRealTime from the new platform.

Another novelty on the upgraded web platform is the ability to export a chart. The chart(s), once exported, can be attached in a mail or printed out. The IG team stresses that this feature has been in high demand by traders.