IG unveils new feature for ProOrder automated trading users of ProRealTime

ProOrder automated trading users of ProRealTime can now have an email concerning their strategies automatically sent.

The team behind IG Community – a forum operated by electronic trading major IG Group Holdings plc (LON:IGG), has informed clients of the broker of a new feature which has been implemented on the back of client feedback. ProOrder automated trading users of ProRealTime can now have an email automatically sent whenever their trading strategy is:

- Stopped (for any reason);

- Due to expire in “x” days.

This addition to the PRT aims to help traders stay in control of their automated strategies whilst they’re running but a trader is not at his/her computer.

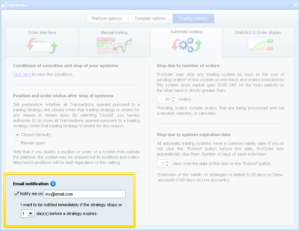

To set this feature up, one has to launch ProRealTime and head to Options > Trading options > Automated trading > Email notification:

An example of recent changes due to client feedback concerns PRT too. Some clients have been saying that using Pro Real Time for the first time can be quite difficult because of the flexibility, complexity, and customisation options of the charts. In response, ProRealTime has now implemented walkthrough wizards to guide clients through using PRT for the first time (and for specific features like customising deal templates).

The advanced charting package includes more than 100 indicators covering everything from price to volatility, as well as an improved interface fully integrated with the new IG Trading platform. Traders get the ability to trade and set orders directly from charts. They can also make use of fully customisable layouts, colours, product groups and chart cursor.

In the new IG Trading platform, traders can find ProRealTime by clicking a market’s name above its chart.

Let’s note that ProOrder automated trading enables traders to automate their spread betting and CFD trading, as well as to build strategies using assisted creation tools, or code them from scratch. Traders can also import and export strategies, including those created by third parties. Trades are executed day or night, even if one’s computer is turned off. PRT also allows backtesting against up to 30 years of historical data.

IG has been enhancing its web trading platform. In July this year, the broker added new functionalities to the platform charts. For instance, traders got the ability to partially close positions via the charts.

This new feature is available on charts for both the web trading platform and on mobile. When ‘1-click dealing’ is not enabled, traders are able to confirm whether or not they want to close the whole position, or to partially close via a pop up dialogue box. To use this functionality, traders must click ‘close’ (1) on the chart, change the ‘Sell’ value (for example in the screenshot below they can change 4 to 2 to only close half the position), followed by ‘Submit’. The window will show the ‘Closing P&L’ as well as the ‘Margin Returned’.