Interactive Brokers enhances access to fundamentals data in TWS platform

The latest version of the platform features Fundamentals Explorer, including Company Profile, Financials, ESG Rating, Key Ratios, Competitors and more.

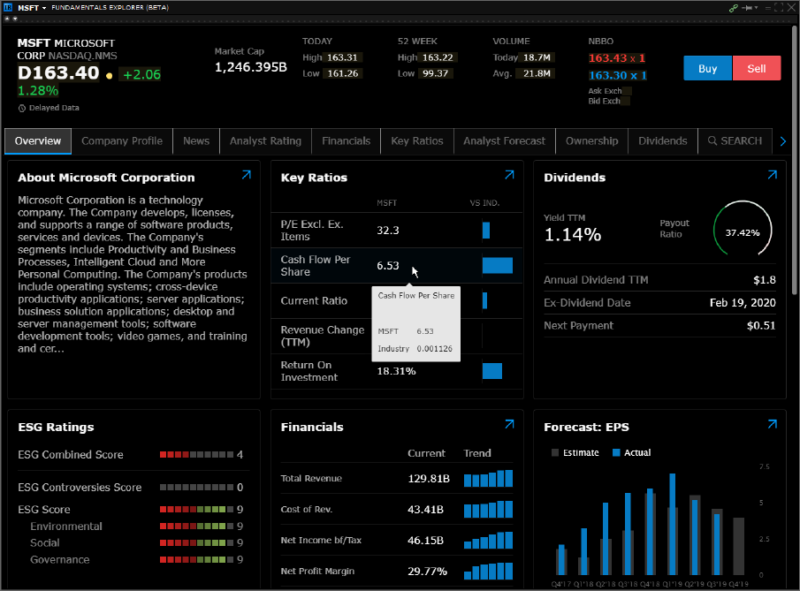

Online trading major Interactive Brokers continues to bolster the capabilities of its TWS platform. The latest (beta) version of the platform offers traders enhanced access to company fundamentals data on stocks and mutual funds via the Fundamentals Explorer.

The functionality aims to help traders better gauge the fundamental value of an asset. The explorer includes Company Profile, Financials, ESG Rating, Key Ratios, Competitors and more.

The company has added more than 200 new company and ETF ratios including graphical trends to show how key financial ratios have trended in the past five years and comparisons to peers within the same Thomson Reuters Business Classifications. Traders can expand on the ratio to view a bubble chart comparing the same ratio against four peers with the nearest market capitalization, and compare ratio trend values with a peer. Traders can also select a competitor to continue their fundamentals research.

On top of hundreds of fundamentals data values, the brokerage now provides a cross-link between company reported statement filings and analyst forecasts for key values, and has added graphical charts to help traders quickly assess data trends and surprises to analyst’s estimates.

To access the Fundamentals Explorer in TWS, enter a stock or fund symbol and from the New Window drop-down select Fundamentals Explorer. Use the tab set below the quote details to move between categories. Hold your mouse over graphical values to see more depth.

The Fundamentals Explorer is free to all clients and trial users.

The latest TWS version offers a raft of other enhancements too. An Allocation Order Tool is made available for FAs, Money Managers, Allocating IBrokers. It makes managing Allocation Profiles more efficient. This interface combines TWS allocation elements into a single tool that makes it easy to create order allocations to:

- Reduce or exit an existing position;

- Increase or open a new position;

- “Rotate” positions (close some and open others almost simultaneously).

To open the Allocation Order Tool, from a market data line or order line (for an un-transmitted order), use the right-click menu to select Allocation Order Tool. Alternatively, from the Allocation drop-down field in any tool, select Allocation Order Tool.