Interactive Brokers merges iPhone and iPad apps into universal mobile application

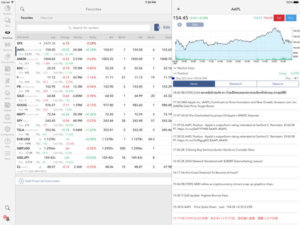

The latest version of IB TWS makes the solution a universal app, that is, the same mobile application can be installed both on an iPhone and an iPad.

Electronic trading expert Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just released the latest version (8.36) of its IB TWS application for iOS devices. The key enhancement is that the solution is now a universal application, that is, the same version can be installed on an iPhone and an iPad.

The merger of iPhone and iPad apps is not a novel move for the online trading industry. Swissquote, for instance, introduced this change to its Mobile Banking and Trading Solution in March this year.

The creation of universal apps for iOS devices is somewhat controversial, however, with programmers not welcoming it usually, as it implies heavy coding and restrictions on what may work on both devices and what may not. One programmer once named this problem “The Frankencode”. For instance, if a bug emerges on an iPhone, then users of iPad have to download an updated version of the app although it was not the iPad that triggered the problem. Or, users have to wait for a long time for a new release until it works well on both types of devices.

The creation of universal apps for iOS devices is somewhat controversial, however, with programmers not welcoming it usually, as it implies heavy coding and restrictions on what may work on both devices and what may not. One programmer once named this problem “The Frankencode”. For instance, if a bug emerges on an iPhone, then users of iPad have to download an updated version of the app although it was not the iPad that triggered the problem. Or, users have to wait for a long time for a new release until it works well on both types of devices.

The benefits of a universal app are also for users, the first being that they no longer have to download different apps on different devices. Also, in case they have in-app purchases, this will save them money.

In addition, anecdotal evidence says that companies offering universal apps rank better in iTunes.

The preceding updates to IB TWS for iOS devices have focused on IBot, the natural interface to trading developed by Interactive Brokers. The artificial intelligence solution that was first introduced by the broker in the fall of 2016 and has since been growing smarter, as it gets to search more areas to provide answers to more questions.

IBot can now search knowledge databases to deliver answers to customers’ questions. The TWS platform also integrates Interactive Brokers’ website search with IBot to allow educational and task-based returns. With the integration, IBot can respond to questions like “How do I fund my account?” and “How do I transfer funds?” by returning the top five best information links from Interactive Brokers’ website.