Interactive Brokers rolls out updated IBKR Mobile app, introducing mobile ChartTrader

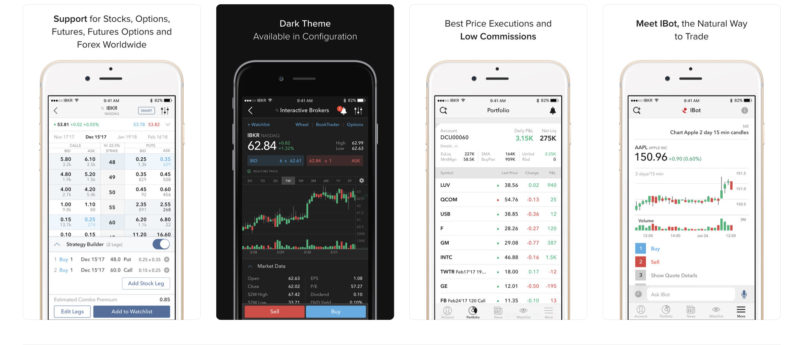

Traders can use ChartTrader to set order pricing right from the chart through the IBKR Mobile app for iOS devices.

Electronic trading major Interactive Brokers LLC continues to beef up the capabilities of its mobile trading solutions. The IBKR Mobile app for iOS-based devices has just been updated, with the latest version (8.57) offering a raft of enhancements, ranging from addition of a new order type to improved access to the Services screen.

The newest version of the app introduces MidPrice orders for stocks. As FinanceFeeds reported when covering the enhancements to the TWS Desktop platform, MidPrice orders are designed to split the difference between the bid and ask prices, and fill at the current midpoint of the NBBO – or better.

Also, the latest version of the IBKR Mobile app introduces mobile ChartTrader. Traders can now use this intuitive and powerful tool to set order pricing right from their chart. They can open the chart from the sidebar on order entry, or use 3D touch on the chart to define a limit order.

Another improvement concerns Calendar Events, as users of the app can now view Instrument Details and place an order from an event.

Other updates include:

- Full screen width on the new iPad Pro is not supported in IBKR Mobile.

- The Services screen is now easier to access from within a trading session with a link at the top left of the More menu.

- The Authenticate and Debit Card buttons have been moved to the Services menu.

- Debit Card access has been moved into the new banking menu.

The preceding version of the app enabled its users to add selected Events Calendar events to their device calendar. To do this, tap an event to display the Event Report. At the bottom right of the screen tap “Add to calendar.” Agree to allow Events Calendar events to be added to the calendar once.

Users of the app can also create an Alert using an event. From the Events Calendar, tap an event to open a report, and from the bottom left of the screen tap “Add alert.” Use the wizard to finish creating the alert.