Interactive Brokers’ TWS gets equipped with 3D Volatility Surface Webtool

Traders simply have to click on the “3D” button to study the model volatility surface of contracts in 3D.

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) continues to enhance its proprietary platform TWS, with the latest build (969) of the solution being equipped with a 3D Volatility Surface webtool.

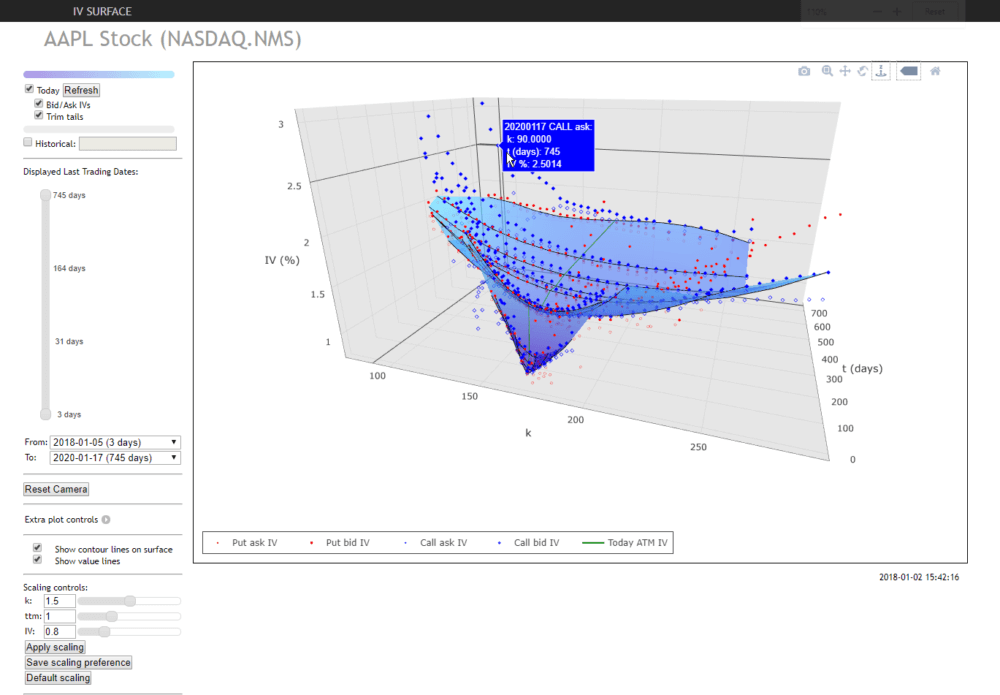

Traders can now view Implied Volatility in 3D using the 3D Volatility Surface webtool accessible from within the Implied Volatility Viewer. All they have to do is click the “3D” button to study the model volatility surface of contracts in 3D.

As a result, the platform displays the model surface together with individual option IV points. And traders can also compare the current surface with any historical value by plotting them together. The view can be rotated and zoomed. If one expands the “Extra plot controls”, contour and value lines will be shown. Scaling can be manipulated using sliders.

The list of enhancements to the IB Risk Navigator includes the ability to open the Implied Volatility Viewer using the right-click “Charts” menu from any instrument line, and from with Risk Navigator using the right-click menu from any instrument.

There are two new columns, “Adjusted Vega” and “Custom Adjusted Vega” which can be added from the Metrics > Position Risk menu. The Adjusted Vega multiplies the Vega by an in-house term structure function. The custom adjusted vega (Vega x T-1/2) multiplies the Vega by the inverse square root of the number of calendar days to expiry.

In addition, traders can now add borrowing power and Debit card spending limit estimations to the dashboard view from the View menu, and can remove unresolved positions from the right-click context menu of the Not Included list.

The improvements in the latest build of the TWS platform also include support for MiFIR reporting.

Users can define default TWS and API decision-maker and execution trader values in Global Configuration for MiFIR reporting. To access these settings, in TWS Global Configuration they should go to Orders and then select MiFIR. Users can define default values including: TWS Defaults (Decision Maker is the owner of the account, Decision Maker is myself, etc); API Defaults (Decision Maker, Decision Algo, etc); Execution Defaults (Execution Trader, Execution Algo, etc).