Interactive Brokers’ TWS platform enables aligning investments with principles

The brokerage has expanded its ESG ratings functionality to include the ability to identify companies engaging in controversial business practices.

Electronic trading major Interactive Brokers continues to beef up the capabilities of its TWS platform. The newest (beta) release of the platform enables aligning investments with principles.

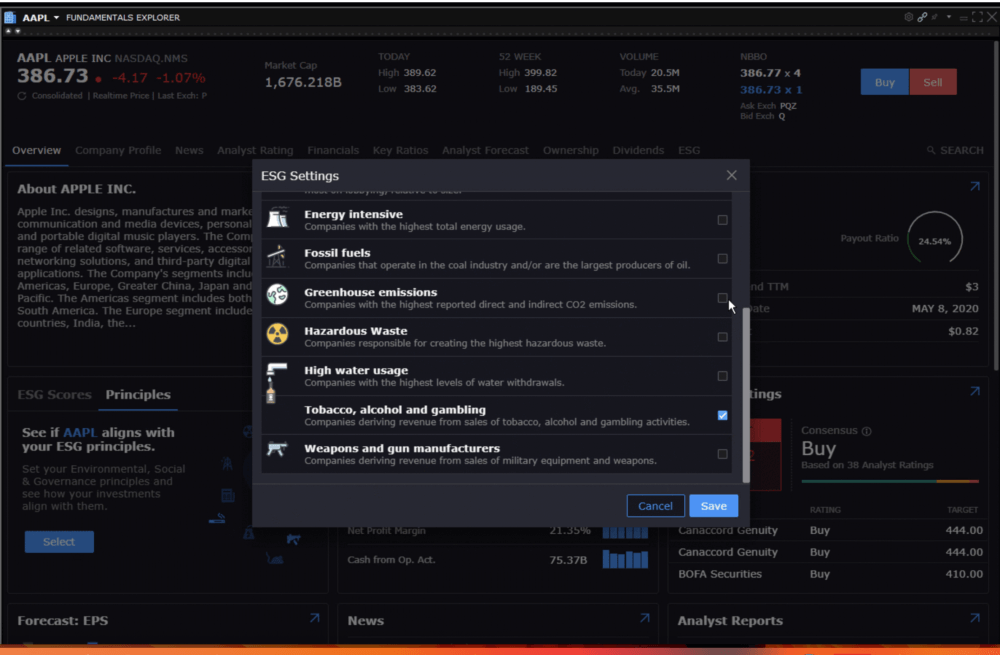

The more you know about a company, the better investment decisions you can make. Interactive Brokers has expanded its Environmental, Social, and Governance (ESG) ratings functionality to include the ability to identify companies engaging in controversial business practices that do not align with one’s values.

Use the ESG tab in Fundamentals Explorer to tag activities that concern you, such as:

- Animal testing: Companies selling personal and household products and services that are tested on animals.

- Business ethics controversies: Companies associated with the highest number of ethical, political and corruption-related controversies, as reported in the media.

- Corporate political spending and lobbying: Companies that donate the most in support of political parties/candidates and spend the most on lobbying, relative to size.

- Energy intensive: Companies with the highest total energy usage.

- Fossil fuels: Companies that operate in the coal industry and /or are among the largest producers of oil.

- Greenhouse emissions: Companies with the highest reported direct and indirect CO2 emissions.

- Hazardous waste: Companies responsible for creating the largest volume of hazardous waste.

- High-water usage: Companies with the highest levels of water withdrawals.

- Tobacco, alcohol and gambling: Companies that derive revenue from the sale of tobacco and alcohol or from gambling activities.

- Weapons and gun manufactures: Companies that derive revenue from the sale of military equipment and weapons.

When traders look at a company in Fundamentals Explorer, they can look at the Principles section of the ESG Scores/Principles widget on the Overview page to see how a company’s practices align with the principles they hold.

To define their principles, traders need to open the Fundamentals Explorer from the Mosaic New Window drop-down. Then they have to select the ESG tab and use the Principles tile to tag controversial business practices that concern them.

This functionality is currently available in Desktop TWS, with Interactive Brokers promising that it will be available soon in Client Portal and IBKR Mobile.

Let’s note that the latest (beta) version of the TWS platform also comes with a new Learn Tab. TWS users can watch video tutorials, browse some of Interactive Brokers’ most-requested FAQs, and keep abreast of the latest News@IBKR all without leaving TWS. The new Learn tab showcases all of the latest and all of the greatest features that TWS and IBKR have to offer.