Investment fraud costs more than $5 million to Australians in Feb 2018 – Scamwatch

The amount of losses due to investment fraud continued to climb during the shortest month of the year and topped $5 million.

The latest monthly statistics from Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC), have been published earlier today and the data adds to gloom concerning the scope of investment fraud in Australia.

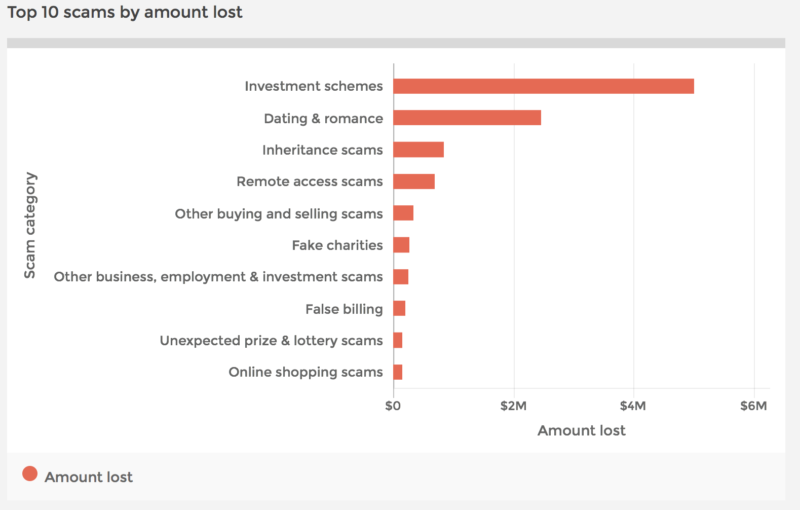

According to the latest numbers, Australians reported $11,033,635 lost to various types of fraudulent schemes in February 2018, with investment scams topping the list of illicit schemes in terms of losses caused. The data shows that nearly half of all losses were due to investment scams – $5,005,307. The sum marks an increase of 8.7% from the investment fraud losses of $4.63 million reported in January 2018.

The bulk of investment fraud was perpetrated via phone and online means (Internet, email, etc). Regarding victim profile, the data shows that those aged from 35 to 44 years submitted the highest number of reports, whereas the biggest amount lost was reported by those aged 45-54.

A type of investment fraud that is currently on the rise in Australia involves cryptocurrencies. Earlier this week, Consumer Affairs Victoria, a business unit of the Department of Justice & Regulation, within the Victorian government, has voiced its concerns about Bitcoin scams.

Victoria’s consumer regulator said it had received reports of people being scammed through fake Bitcoin websites. The average amount lost is not that large – around $300, but apparently such type of fraud is worrisome.

This is not the first time Australian regulators warn about Bitcoin fraud. In October last year, the Australian Communications and Media Authority (ACMA) warned the public of scams targeting people who use crypto currencies like Bitcoin and Ethereum. In particular, the authority noted a number of fake Blockchain URLs and a Bitcoin survey that are indeed scams that aim to collect personal information.

Australians reported losses of more than $31.15 million due to investment scams in 2017, according to Scamwatch. The losses mark a 32% increase from the losses of $23.63 million reported by Australians hit by investment fraud in 2016.