Japanese brokerages increasingly adopt AI solutions, SMBC Nikko Securities to launch AI Chatbot

While worries rise that such chatbots may replace human staff, SMBC Nikko Securities insists that the AI Chatbot will help its employees achieve a better work-life balance.

FinanceFeeds has been exploring the topic of robots replacing human customer support staff and the first examples in this respect have been provided by Japanese companies. The trend has gathered speed since and it comes as little surprise that more Japanese financial services companies have adopted artificial intelligence (AI) solutions.

Another Japanese securities brokerage planning to use an AI-based solution that will overtake customer support staff functions is SMBC Nikko Securities, a subsidiary of Sumitomo Mitsui Financial Group, Inc. (TYO:8316). The companies have announced a partnership with NTT Communications Corporation to jointly develop an automated chat service using AI.

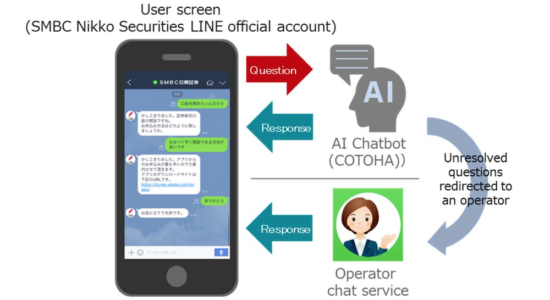

This service will become available as of May 25, 2017 at SMBC Nikko Securities’ Contact Center and aims to enhance its LINE-based enquiry service. AI Chatbot is capable of understanding customer input on LINE Talk and then automatically and rapidly provide the most appropriate response.

One of the main advantages of the AI Chatbot is that it will allow faster responses to customer enquiries. At some future point, AI Chatbot is set to be accessible during nighttime hours and holidays, time periods when the (human) chat service has thus far been unavailable.

Once launched this month, AI Chatbot will provide guidance on ways to open accounts, as well as on initial public offerings, NISA, etc. The scope of this service will be gradually expanded to include share price enquiries and investment trust selection.

The service uses NTT Com AI engine called COTOHA that can engage in human-like dialogue. A crucial aspect of the program is that it is capable of learning: COTOHA studies the responses of operators in order to upgrade its own response capabilities. However, it does not know the answers to all questions, so it comes with an escalation function that redirects customers to a human operator for questions that cannot be answered by the bot.

Whereas many are concerned that human employees are about to lose their jobs over robots, SMBC Nikko Securities has a different point of view. The company believes that AI will help its employees achieve a good work-life balance.

Indeed, robots are likely to significantly reduce the risk of burn-out. It is not a random fact that Japanese companies rush to adopt AI solutions. According to a recent study, at least 12% of Japanese employees work extra 100 hours a month, whereas 20% of the employees are in danger of Karoshi. “Karoshi” is the Japanese term for “death from overworking”. There is a law pushing Japanese companies to implement measures to minimize such risks for their staff. Enrolling robots is one way to do it.