KDDI to acquire shares in Mitsubishi’s online trading business kabu.com Securities

After the change, KDDI’s new subsidiary LDF will hold a 49% stake in kabu.com Securities.

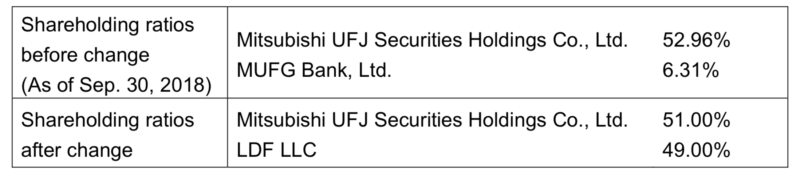

There are some ownership changes looming for kabu.com Securities, an online trading business whose ultimate parent is Mitsubishi UFJ Financial Group Inc (TYO:8306), or MUFG.

MUFG, its subsidiaries Mitsubishi UFJ Securities Holdings Co., Ltd. (MUSHD) and MUFG Bank, Ltd., today announce that they have entered into an agreement with KDDI Corporation to conduct share capital changes concerning kabu.com Securities.

KDDI decided at a meeting of its Board of Directors today that LDF LLC, a wholly-owned subsidiary it plans to establish, will launch a tender offer to acquire ordinary shares (excluding ordinary shares held by MUSHD) and new share acquisition rights of kabu.com Securities.

In addition, MUSHD and KDDI today concluded a shareholders’ agreement pertaining to LDF’s launch of the tender offer, the post-tender offer management of kabu.com Securities, and other matters.

MUFG Bank decided at a meeting of its Executive Committee today to subscribe 21,035,200 shares (6.31%) to the tender offer and concluded an agreement with KDDI pertaining to the tender.

MUSHD, KDDI and kabu.com Securities also concluded a business alliance agreement agreeing that, subject to completion of the tender offer, in order to grow kabu.com Securities’ business to a scale comparable to those of leading competitors specialized in online securities, they will focus on expanding its customer base and strengthening product competitiveness through continuous support from MUSHD and referrals from KDDI’s customer base, maximizing corporate value, and renaming the firm au kabucom Securities Co., Ltd.