Largest interbank FX institutions experience yet more collapsing share prices after dead-cat bounce

The collapsing share prices of some of Western Europe’s largest banks, most of which are among the largest interbank FX dealers in the world, continues unabated. During the past few weeks, the combination of large corporate losses, in the cases of some large institutions, the first losses since pre-financial crisis 2008, have blighted the balance […]

The collapsing share prices of some of Western Europe’s largest banks, most of which are among the largest interbank FX dealers in the world, continues unabated.

During the past few weeks, the combination of large corporate losses, in the cases of some large institutions, the first losses since pre-financial crisis 2008, have blighted the balance sheets of the prominent institutions of London and Frankfurt.

One of which is Deutsche Bank AG (FRA:DBK) which is the second largest interbank FX dealer in the world with 14.54% of global market share during 2015, having sustained a £4.4 billion loss in the third quarter of last year, when its forecasters had been redicting a 1 billion Euro profit.

Whilst this was clear testimony to the inaccuracy of that particular forecast, a matter that was discussed at length at this year’s iFXEXPO Asia 2016 in Hong Kong hosted by ConversionPros and Finance Magnates, it is now a case of downward spiral for share prices of the large banks following two days of what is known as a ‘dead-cat bounce’, which is a temporary recovery in share prices after a substantial fall, caused by speculators buying in order to cover their positions.

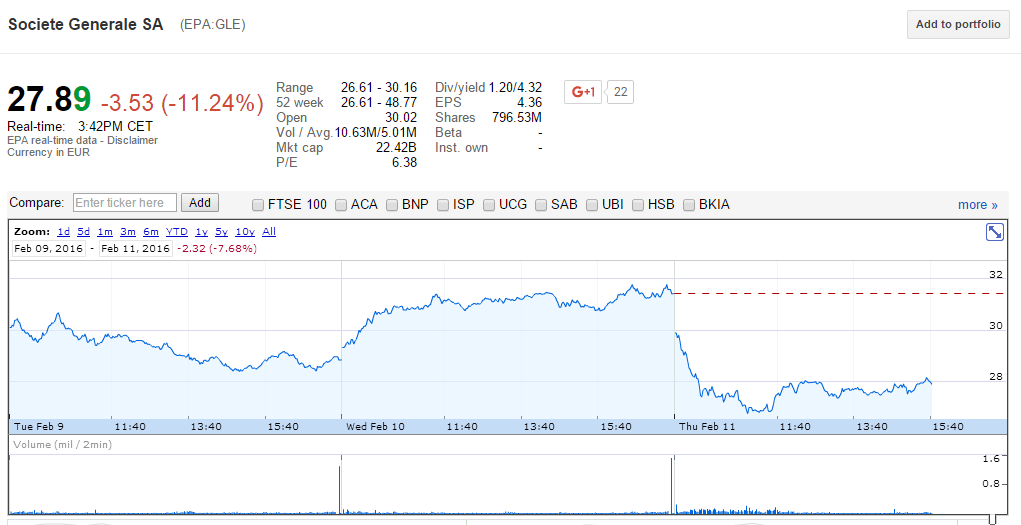

Now that this two day recovery is over, the precipice that the shares of Societe Generale SA (EPA:GLE), Barclays PLC (LON:BARC), Barclays PLC(LON:BARC), RBS and HSBC have fallen over is once again very steep.

Societe Generale, the world’s 11th largest interbank FX dealer by market share with 2.43% of the global order flow on its books in 2015, has led this downward rally, with its shares down 11.49% since yesterday, languishing at EUR 27.84 at present.

Just two days after Germany’s finance minister Wolgang Schaeuble publicly announced that he had “no concerns over Deutsche Bank” on the same day as John Cryan, the company’s CEO sent a memo to employees stating that the bank is “rock solid”, the concerns over the bank’s capital position have resurfaced, and share prices are now down to another 5.21% to EUR 13.74 today.

Whilst Societe Generale’s net income actually rose to €656 million (£515m) from €549 million a year earlier, it still fell considerably short of analysts’ expectations of €944 million, however this was still enough to influence investor confidence.

In the UK, Barclay share prices are down six 6%, while HSBC, Lloyds Banking Group and Royal Bank of Scotland are all experiencing share price drops of approximately 4%.

Chart courtesy of Google Finance.