Which leads cost the most? You’ve guessed it…..

The cost of leads in the financial services industry is dramatically higher than any other business. How do you decide whether a lead source is genuine? Modernization is the key

If there is one metric that can be looked at very quickly and compared to the same metric in other business sectors around the world in order to encourage executives within retail FX brokerages to begin to rethink the marketing model, it is the cost of leads.

Ever since the access point to the retail market was lowered dramatically by the launch of third party trading systems that could be very easily white labeled for a small fee, the most important being MetaTrader 4 almost 15 years ago, the de facto model for onboarding clients by small to medium sized retail electronic trading companies has been to buy leads from external sources and then use an internal sales team to convert the leads to live accounts.

This intertwining with the affiliate marketing business has created a situation in which there is a tremendous overlap between retail FX and affiliate marketing entities, however the cost of leads is now a major consideration and has been for several years, regardless of which the status quo continues.

With cost of client acquisition being approximately $1200 per new client, an average deposit of $3800 (outside the United States), and a client lifetime value of just six months, compounded by very easy onboarding of one broker’s clients to another due to the similarities of product and service offering which is largely all based on MetaTrader, margins are narrow to say the least.

What is noticeable is that the return on investment (ROI) parameters are being looked at purely from a retail FX point of view, and very rarely are comparisons made with the affiliate marketing and customer acquisition procedure and associated costs in other industry sectors.

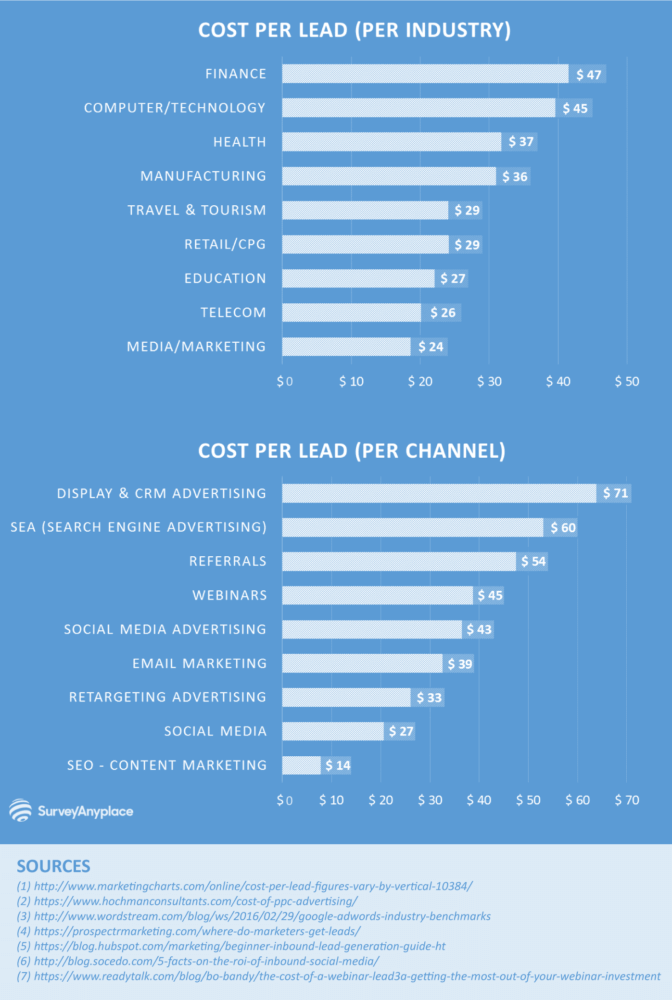

When doing that, it is clear to see that the financial services business has by far and away the highest lead costs of any industry sector globally.

Leads for financial services company cost an average of $47 and to compound this, traditional media buying channels are the most expensive at $71 whereas referrrals are substantially less at $54 per lead.

Indeed, these costs include other areas of the financial services business, such as insurance, pensions and standard retail products available on the high street such as ISAs, however, it is worth remembering that high street products are usually marketed and sold directly via banks when a retail customer makes a counter transaction at the local branch or via televised adverts that reach out to a domestic client base.

The electronic trading lead business is a bit different because brokerages need to appeal to all kinds of customer in all kinds of region with all kinds of differences in preferences and expected outcomes, hence the stalemate situation that many firms find themselves in.

A point to bear in mind here is that if the average cost of a lead is this high, the litany of telephone calls received by FX brokerages from entities wishing to sell them ‘qualified’ leads for between $20 and $40 can be considered disingenuous on the basis that these are likely to be former employees of retail firms attempting to illegitimately sell on customer data.

FinanceFeeds approached three of these entities, however we believe that they are all connected and that it is a band of former binary options salespeople who have stolen leads and are now offering them on the open market. “Ping Me For Leads” stated the front page slogan on the messenger used by one particular entity. Hmm, how inviting. I might just do that….

Our conversation began with one particular sales person stating “Let me explain how we qualify leads. We have a call center in house, where we qualify leads, and for each lead you get fully verified details, (no wrong numbers, duplicates etc.), they will be all in a position to invest, they expect to get a call and to be made an offer to trade from your sales team, and all leads are qualified in an individual campaign for each client and are branded (we introduce your brand, promotions etc.)”

(Editor’s note. I had to straighten the English out here. Normally, the addition of the abbreviation sic. would be enough, but to comprehend what was an incoherent written sales pitch, I needed to adjust the English significantly. John Smith, my foot.)

The salesman was then asked by FinanceFeeds how the leads are acquired. “We get them from our funnels – financially related seminars, webinars, e-books etc”. I would love to know what the “etc” is. Sounds fascinating. Perhaps it is an acronym for ‘entirely, totally corrupt’.

When asked how lead sales people safeguard the leads that they are selling to ensure that they are not stolen, the salesperson backtracked, admitting “We target all of the regions that are popular, however these leads are not fresh and this is the main issue.”

We asked if they had been used by other binary options brands, to which the answer was “Yes exactly.” Make of that what you will.

The price we were offered was 22 euros per lead, and were asked how many we would like to start with.

The company maintained that “Every lead that you receive will speak to our call operators, who will introduce your brand, promotions, offer etc (more etc, interesting) and we will explain the next step which is a sales call from your sales team. Only if they agree this is counted as a lead and we set up a time-slot for the phone call.”

This practice has become so widespread that the platform providers are aware of it. One particular executive within a platform firm once explained that automation is perhaps a means of removing the high pressure sales from the binary options business, a question that FinanceFeeds posed to CySec Chairman Demetra Kalogerou in the summer of this year, her having concurred with this line of thinking.

Recently, FinanceFeeds spoke to Expozive CEO Nicc Lewis, an experienced marketing executive in the FX industry, who explained “Regardless of industry, currently it is common practice for both Affiliates and B2C companies to use Facebook to attract mass traffic at a reasonable cost and backing this with retargeting and keyword campaigns on Google. What will happen if Google and Facebook ban all financial trading advertising?

“Firstly, organic traffic will still be allowed after the ban by some of the internet search engines on display advertising. Building a strong SEO strategy will be essential for Brokers and Affiliates.”

“It is a long term strategy that takes a minimum of 6 to 8 months to start seeing good results. The good news is that organic traffic converts better and has higher user value. However the costs are based on man hours, especially on creating good quality content and keeping a growing a network of natural links” said Mr Lewis.

“Although Google has a massive inventory, they do not have exclusive real estate. Many media agencies will be able to get banner space for brands. The key is to work on a performance base. Optimization for media buying is usually around 3 to 4 months” he said.

“The initial period is unlikely to be on a performance base, meaning upfront investments. The investments are high running to tens of thousands of dollars/euros/pounds. Once optimized the traffic generated should be of a good quality and costs based on performance. Another key factor will be using tracking to operate retargeting through the media networks” explained Mr Lewis.

“Another useful source of traffic can be via Native Advertising (“People who liked… also liked…”). Although some networks have stopped Financial Trading activity, there are still some big networks with good traffic and inventory. This could be used as a replacement in part for Facebook – generated mass cheap traffic to your real estate so that it can be followed with retargeting on CPC or CPA basis” he said.

On that note, trading platforms such as MetaTrader 4 may pose an issue given that the ubiquitous trading platform acts both as a key facet with which to onboard clients and as a retention problem, becoming one of the main criteria when choosing a broker to open an account with, which also means those brokers risk being easily substituted following a minor incident or an aggressive marketing campaign by a competitor.

This may well appear as though it is a complex lesson in mathematics; a matter in which accountants must balance the cost of leasing trading infrastructure from a third party platform supplier against the cost of buying media and generating leads, then subsequently factoring in the cost of sales staff to call the leads and then add up the profit post-conversion.

The reality is that in today’s retail FX industry, where the end users have become ever more sophisticated and can absolutely tell if a broker is surviving from their deposited capital instead of connecting to a live market, which has exponentially improved the standards in terms of execution of trades within many medium sized retail brokerages, however it has left a conundrum, that being the completely outmoded marketing model which is not compatible with the commission business that brokerages offering genuine market execution now provide.

As the infrastructure of OTC electronic trading firms becomes the increasing subject of regulatory remit as defined by the pan-European MiFID II which uses the coercive powers of the European Commission to ensure all market infrastructure and execution policies are standardized across multiple jurisdictions, brokers find themselves faced with high expectations from extremely analytical traders in the most high quality regions for electronic markets, and difficulty differentiating themselves from other retail brokerages using the same third party platforms.

Most importantly, however, aside from the 1231 near-identical MetaTrader 4 retail entities that currently exist, is that the execution model required nowadays means that brokers should do what brokers are supposed to do – charge a commission for processing trades to their liquidity provider and provide their clients with an aggregated price feed consisting of prime of prime liquidity from Tier 1 banks and non-bank market makers.

This is excellent for customers if conducted correctly, but means that brokers pay a dollar-per-million charge for their liquidity management system and market liquidity, and can charge a commission rather than have the vast margins that had been the case within so many smaller brokerages several years ago which resulted from the profit and loss model that many operated.

The brokers that came to market in the middle of the last decade with a profit and loss model (living from client losses) were never able to gain market share among quality jurisdictions where the established competition was already operating a good quality trading environment for clients – and rightly so, nobody laments the passing of firms which do not have their customers’ best interests in mind – instead coming from the affiliate marketing and media buying sector.

Now, many of those entities have adopted proper execution, facilitated by the market infrastructure specialists and prime of prime brokerages that serve the retail FX industry, but their marketing techniques in many cases remain in the mid 2000s, and in the retail FX industry, the mid 2000s is akin to the dark ages.

The fact of the matter is that high CPA of today requires ambitious goals when it comes to the client base, which means having enough available funds to embark on large marketing operations and have a unique value proposition to lower the CPA.

The quest for differentiation may also lead to the in-house development and maintenance of proprietary software despite the obvious costs because in addition to promoting their own platform to their clients and increasing the rate of client retention as they grow accustomed to an environment they will not likely find elsewhere, these brokers can also reduce their costs or even make profit out of offering white labeling solutions to other firms.

Simply, buying leads and hoping for sales calls to convert them into live clients is futile, and if recent data is anything to go by, very expensive too.

Very soon, FinanceFeeds will be launching an entirely new subsidiary aimed at resolving this matter to a great degree, for the benefit of FX brokerages globally. Watch this space!