Leucadia revises FXCM loss exposure estimate, confirms Drew Niv holds active role in Global Brokerage

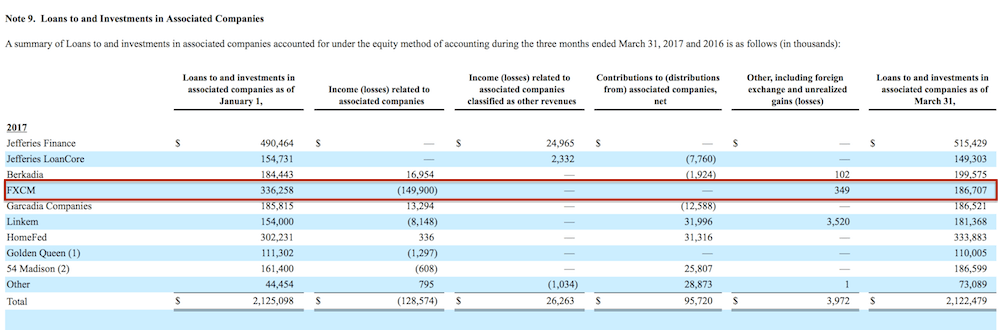

Leucadia’s maximum exposure to a loss from its involvement with FXCM includes the carrying value of the term loan ($132.8 million) and the investment in associated company ($186.7 million).

Leucadia National Corp. (NYSE:LUK) has published a detailed financial report for the first quarter of 2017 with the United States Securities and Exchange Commission (SEC), with our attention pinned on any mention of FXCM, given that the brokerage’s settlements with US regulators happened during the period covered by the report.

As per Leucadia’s previous financial report – the one for the full year to December 31, 2016, its maximum exposure to a loss as a result of its involvement with FXCM was $500.8 million. In the latest report, the estimate is revised to $319.5 million. Leucadia explains that its maximum exposure to loss due to FXCM stood at $319.5 million at March 31, 2017, with the number representing a sum of the carrying value of the term loan ($132.8 million) and the investment in associated company ($186.7 million).

Regarding the repayment of the loan that Leucadia extended to FXCM back in January 2015, the company says that it received $42.7 million of principal and interest from FXCM during the three months ended March 31, 2017, with $123 million remaining outstanding under the term loan as of March 31, 2017. The proceeds from the sale of FXCM’s US retail FX accounts to GAIN Capital, as well as regulatory capital released after a sale, have been used to pay down the Leucadia term loan.

FXCM is considered a variable interest entity (VIE) and Leucadia’s term loan and equity ownership are variable interests. Leucadia has determined that it is not the primary beneficiary of FXCM because Leucadia does not have the power to direct the activities that most significantly impact FXCM’s performance.

Leucadia does not hold any interest in Global Brokerage Inc, formerly known as FXCM Inc, the publicly traded company and issuer of senior convertible notes. Global Brokerage holds an economic interest of 74.5% in Global Brokerage Holdings, which holds 50.1% of FXCM. Leucadia owns the remaining 49.9% of FXCM, and its senior secured term loan is also with FXCM, which is a holding company for all of FXCM’s affiliated operating subsidiaries.

Another point to highlight in Leucadia’s report: Drew Niv’s status. As FinanceFeeds has informed you, Drew Niv retains an Interim CEO role in Global Brokerage. Leucadia’s latest report confirms that “on February 21, 2017, Mr. Niv resigned from his positions as Chief Executive Officer and Chairman of the Board of Global Brokerage, but remains as acting Chief Executive Officer of Global Brokerage until his successor is identified”.

This is the situation nearly three months after US regulators published their findings into the misleading business practices used by FXCM in the US between 2010 and 2014.