MiFID II is just a matter of weeks away. Who is ready? Exclusive report from London

At The Ned in London, full and comprehensive information was provided on how to comply with MiFID II, which comes into effect in January. Senior industry leaders from CME and TRAX, along with industry specific Advocates and regulatory technology firm Cappitech explained vital information to London’s firms. FinanceFeeds reports

January 2018 seemed such a distant date in the future, by which time surely all companies which operate electronic trading businesses within the jurisdiction of the European Union would be ready for the all-encompassing new MiFID II rulings.

Or would they?

Whilst trade reporting has been in place for over twenty years, and the large institutional repositories are very well established in London, Chicago and even Frankfurt, many OTC retail firms are now in a situation in which January 2018 does not seem so distant and are faced with the challenges of implementing very complex infrastructural changes to the topography of their businesses and have it completed within a matter of just a few weeks.

Indeed, the completion of what is required to comply with MiFID II is one challenge, but understanding what is required is another, as the European Securities and Markets Authority (ESMA)’s guidance on all matters compliance related has been notable by its absence.

For this reason, it is critical that specialist companies which provide technological solutions for brokerages to be able to comply with MiFID II continue to provide very clear information to the compliance departments of OTC derivatives companies, and this week, a very comprehensive insight was provided by boutique financial technology company Cappitech, along with FX industry specific law firm Tal Ron Drihem & Co.

The symposium, which took place yesterday morning at the highly prestigious “The Ned” venue next to Bank Station in London’s Square Mile, was comprehensive and covered all aspects that are required of brokerages when MiFID II comes into force in January next year.

Price quality, speed of execution, likelihood of execution, settlement size, information relating to execution venue and financial instrument traded are all measures that MiFID II’s reporting reuqirements will cover, and the amount and nature of the reported data must be published and be made available for public viewing on a quarterly basis.

According to Cappitech CEO Ronen Kertis and Advocate Tal Itzhak Ron of Tal Ron Drihem & Co, the ideology behind the symposium was to have delegates receive answers to their queries relating to MiFID II implementation.

Cappitech’s expertise in regulatory reporting and Tal Ron, Drihem & Co.’s expertise on legal matters relating to electronic financial businesses worked hand in hand to give attendees a full understanding on matters such as how to solve compliance issues via technology, how to deal with challenges facing the FX Industry and collect data from LEIs, how to monitor Best Execution, and identify Decision Makers.

The event’s agenda was tailored to meet the exclusive needs of retail and institutional brokers, and most of the attendees were senior compliance officers, CEOs, COOs, CTOs, and Chief Risk Officers within London’s electronic trading sector.

Commencing the symposium was Len Delicaet, Commercial Manager at TRAX, who is a regular speaker at regulatory and trade reporting conferences.

Mr. Delicaet went into great detail with regard to what MiFID II transaction reporting data is going to be used for and how the FCA and other regulators can spot patterns in the data to find suspicous behavior, as well as comprehensively covering what aspects are part of the for transaction reporting.

ThinkMarkets Director of Compliance Adil Siddiqui then led a discussion panel, in which the subject of firms considering the compliance ramifications of changing liquidity providers and trading platforms. An example in this was brought into the forum by Mr Siddiqui, who said “if you change a liquidity provider to one which does not provide delegated reporting, you may end out paying more money and doing more work than originally thought.”

The discussion on this matter was participated in by Mr Delicaet of TRAX, Advocate Tal Ron, and also Cappitech’s Ron Finberg.

Mr Finberg is widely recognized as a senior figure with a detailed understanding of the market infrastructure that ranges from Tier 1 bank in-house system topography to how retail brokerages connect to their providers.

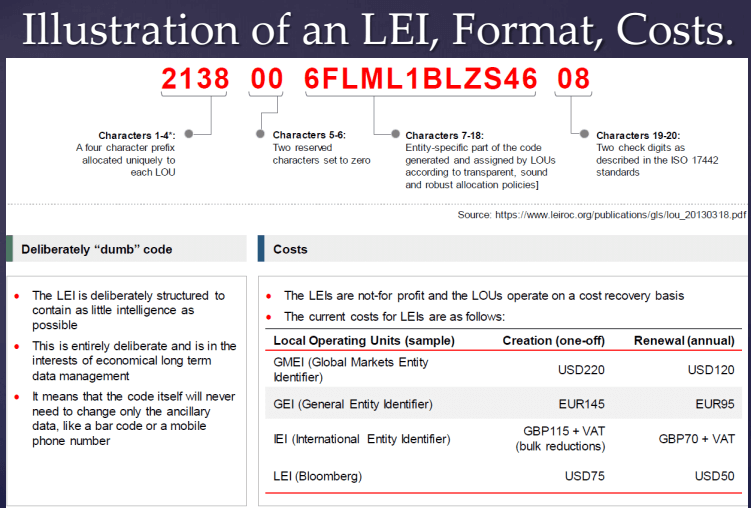

Jonathan Thursby and Jonathan Tsang of CME Group. one of the world’s largest trade depositories, took a close look at what is changing in the EMIR Level 3 implementation, and Maayan Dana, Stephanie Attias and Advocate Tal Ron gave insight into how to collect customer Legal Entity Identifiers (LEIs) and monitoring best execution, along with a particularly important definition on Decision Maker Identification that applies to MAMs and copy trading.

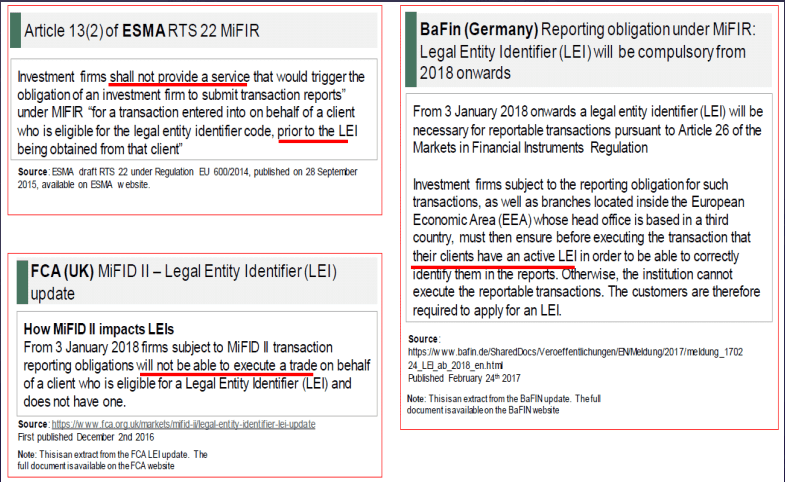

Mr Ron explained that from 3 January 2018, firms subject to MiFID II transaction reporting obligations will not be able to execute a trade on behalf of a client who is eligible for a Legal Entity Identifier (LEI) and does not have one.

Even non-EU financial clients must have an LEI.

What is an LEI? You will NOT be allowed to trade without one

An LEI is a unique identifier (code) for legal entities or structures including companies, charities and trusts. The code is included in a global data system and identifies parties to a relevant financial transaction in any jurisdiction.

If you are subject to MiFID II transaction reporting obligations or are a UK branch of a third country firm, you will need to ensure that your clients are eligible for an LEI and have one before executing a transaction on their behalf in a financial instrument subject to the MiFID II transaction reporting obligations.

Alongside colleague and fellow lawyer Stephanie Attias who previously worked for the United States Securities and Exchange Commission (SEC), Mr Ron explained that for clients with a new customer identification and LEI, collection should be done during onboarding, whereas for existing clients, clients should be advised that they need to register for an LEI or they can’t continue trading after January 3 rd 2018.

Due process should be in place to collect & store client LEI data, and LEI information should be mapped against account numbers for inclusion in EMIR and MiFIR reports.

Brokers need to have a method to register which client trades are executed via an external decision maker, for example, the comment field in MetaTrader reports.

With regard to decision makers, those being a natural person making the decision to acquire/dispose of a reportable financial instrument or modify an existing contract (e.g. portfolio

manager), the definition extends to include committees making such a decision, using a unique identifying code with the prefix “COM”.

Where this applies, firms must keep adequate records of the composition of the committee, and provide those. It also includes a person executing a transaction (e.g. the trader), as well as any algorithm making a decision to trade, and indeed any algorithm actually executing a transaction.

Thus ‘best execution’ does not just mean giving the best speed and price, but it involves exactly how, where and why a specific trade was executed, and on what venue, via what methodology and why a decision was made to do so.

CME Group’s Jonathan Tsang elaborated in detail on this matter.

Taking a close look at the CME European Trade Repository’s reporting overview, Mr Tsang explained that in November 2015, ESMA submitted the revised Regulatory Technical Standards (RTS) and Implementation Technical Standards (ITS) for Article 9 of EMIR (the transaction reporting) to

the EU Commission for consideration and adoption.

Thus, two years ago, this methodology was already in its advanced stages, and the RTS (regulatory technical standards) changes were proposed in order to address some of the issues that are present in the current EMIR reporting standards and include the most important parts of the EMIR Q&A

documents.

In January 2017 the revised RTS/ITS were published in the Official Journal and came into force on February 10th this year. The go-live date was set as November 1st 2017, which is not far away at all.

Cappitech’s Ron Finberg then detailed very comprehensively how trade reporting will need to take place post MiFID II implementation.

Concurring that merging compliance and IT is a huge headache, Mr Finberg explained that Cappitech’s method is ti conduct a business review to understand what needs to be reported and what data is available, to build modular reference data sets and table matching account #’s and LEIs, to map out product details such as symbol, ISIN, exchange codes and underlying currency map out trade data to MiFID II fields.

On Cappitech’s Capptivate platform, client personal details can be sent using PGP encryption to TRAX ARM without Cappitech receiving sensitve data.

An important matter to consider is that FinanceFeeds is aware that MiFID II will require all firms to publish all of their customer data, which is tantamount to exposing them to publicizing their intellectual property, thus when considering regulatory technology and trade reporting companies, it is important to look for firms that provide this kind of encryption functionality.

In terms of providing facilities to assist brokers comply with best execution requirements, Mr Finberg explained that a broker would provide details of its best execution policy, and there would be no additional integration for reporting clients already sending execution data to Cappitech that is reported for EMIR/MIFID II.

Firms can compare their executions versus Thomson Reuters benchmark rates, provide daily reports of adhereance to internal execution policy and display trades that were problematic, whilst also being able to use risk management tools for trades in client’s favor to spot latency issues and toxic flow.

Indeed, the onus is vast and the changes all-encompassing, however the more detail that can be imparted by specialists, especially in the advent of the new rulings, the better.

Featured image: The Ned, Poultry, London EC2. Copyright FinanceFeeds