Monex starts offering AI-based “medical prescriptions” to improve clients’ Forex trading

The service, available to users of Monex’s FX Plus, will analyze traders’ performance and will issue recipes for improvement.

In line with previous announcements, Japanese retail Forex broker Monex Inc, a subsidiary of Monex Group, Inc. (TYO:8698), today officially launched a new service that taps the capabilities of artificial intelligence (AI) to enhance Forex trading.

The service, developed in partnership with technology expert HEROZ Inc, aims to prescribe AI treatment so that one can improve his/her trading style and, ultimately, one’s trading results. That is, the service, which is available to users of Monex’s FX Plus, will actually result in a sort of “medical prescriptions” for Forex traders.

The service, developed in partnership with technology expert HEROZ Inc, aims to prescribe AI treatment so that one can improve his/her trading style and, ultimately, one’s trading results. That is, the service, which is available to users of Monex’s FX Plus, will actually result in a sort of “medical prescriptions” for Forex traders.

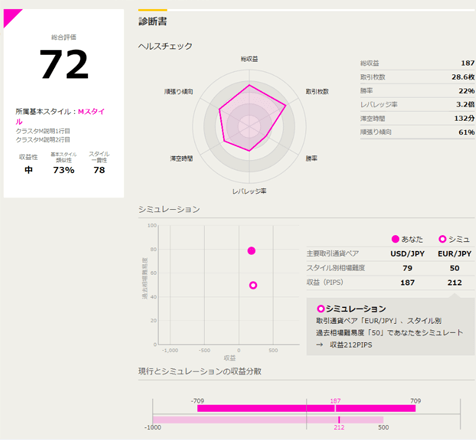

A special AI engine, called Heroz Kishin, analyzes the past trading data provided by a trader. Please, note, that the machine learning process needs a couple of days of to deal with the data. Moreover, a certain minimum number of trades is necessary so that the system has enough data to produce a credible picture of one’s trading style. After the machine learning analysis is ready, it produces a chart, depicting one’s trading style and results.

After that, a trader gets to pick from five target styles. The system will analyze any discrepancies between the current and the target performance and will provide a roadmap to reaching the goals the trader has set himself/herself.

The partnership with HEROZ, which is known for its Japanese chess programs, marks another step into the AI world for Monex. In April last year, the broker unveiled a collaboration with fintech company Good Moneyger in order to deliver a “Monex AI Report” to its customers. Good Moneyger’s AI solution – VESTA, seeks to reduce chances of investment loss by examining market data and cycles and estimating chances of market crashes. The report itself is intended to be simple and understandable – it rates the investment score of various asset classes based on a three-stages scale. There is also a “weather forecast” for the global market, with a map reflecting the business confidence in various regions.

Let’s also note the recent launch of Monex’s robo-advisory service where a customer can determine one’s own investment policy and easily manage his/her assets with a support of professional advice. Unlike discretionary investment, customers can make investment decisions on their own with analyzing the market and the global economy. More than 1,000 patterns of portfolio combinations are available to help customers manage their assets on their own policy.