Monex unveils ¥0.2bn impairment loss due to termination of Japanese equities trading platform “TradeStation”

Monex, Inc., a subsidiary of Monex Group, has decided to terminate its Japanese equities trading platform tool called “TradeStation” for the Japanese market.

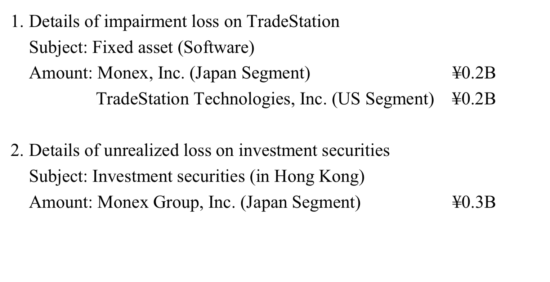

Monex Group, Inc. (TYO:8698) today announces that it has recorded in its consolidated financial statements for the fiscal year ended March 2020 an impairment loss of ¥0.2 billion with respect to the fixed assets owned by Monex, Inc., a wholly owned subsidiary of Monex Group. Monex, Inc. has decided to terminate its Japanese equities trading platform tool called “TradeStation” for the Japanese market.

Monex also announces it has recorded an unrealized loss on investment securities held by the company.

Tooday, Monex Group reported its financial metrics for its fiscal year to end-March 2020. Its Japanese business saw trading volume recover during the 2nd half of the year. Segment profit was ¥ 2.3 billion. (When adjusted for ¥ 0.3 billion of unrealized loss on investment securities and ¥ 0.2 billion of impairment loss on fixed assets, segment profit was ¥ 2.8 billion.)

US equities and FX income significantly increased, while brokerage commissions from Japanese equities and net financial income decreased in the full year to March 31, 2020.

The US business of Monex Group registered increase in profits due to higher trading volume during the period of heightened market volatility even after the decline in interest rates and the introduction of commission free plans. Segment profit was ¥ 1.8 billion.

The Asia-Pacific operations of Monex Group marked a segment loss of ¥ 0.2 billion due to a reserve for bad debt margin loans, even though transaction volumes in HK market increased.

Monex confirms that cost-cutting initiatives were done at TradeStation on April 28, 2020. These measures include reduction in force of approximately 50 employees (about 10% of the entire company) done to achieve circa ¥ 750 million p.a. reduction in costs.