Months after FXCM’s US exit, companies with similar names emerge in Britain

A number of companies bearing similar (or virtually the same) names as those of the entities within the FXCM “family” get registered in the UK.

More than seven months have passed since the United States Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) published the findings of investigations into FXCM’s US operations. As most of you probably remember, these findings led to the broker’s exit from the US retail FX market, whereas FXCM Inc changed its name to Global Brokerage Inc (NASDAQ:GLBR).

While the low price of Global Brokerage shares leaves the door open for a NASDAQ delisting and raises chances of a corporate default, FXCM has sought to distance itself from Global Brokerage. That was sort of an expected move, given the troubles Global Brokerage is going through, and the repeated claims that FXCM non-US operations, which continue under the FXCM brand, would not be affected by what happened in the US in February.

Forex Capital Markets Limited, also known as FXCM UK, has even asserted that it would not face any action from the Financial Conduct Authority (FCA). In May this year, FXCM UK said that “no customer detriment to the Company’s clients has occurred, neither have clients been misled as to the execution policies of FXCM Group. We are therefore comfortable that the Company will not be put into enforcement with the FCA and will not face any fines or public sanctions.”

It seems that the UK is safe haven for FXCM.

It is in the UK that companies with similar (or virtually the same) names as entities within the “FXCM family” have emerged. FinanceFeeds research points to at least three such companies that have recently appeared in the Registrar of Companies for England and Wales.

- Global Brokerage Ltd

Global Brokerage Ltd was incorporated on July 10, 2017. Its address is: Shah House, 1 Browning Street, Bradford, West Yorkshire, England, BD3 9AB. The nature of business stated is: “Other business support service activities not elsewhere classified”. There is one person with significant control – Mr Sayyed Imran Shah.

- Forex Capital Market SA Ltd

Forex Capital Market SA Ltd was incorporated on June 26, 2017, with its registered office address being 14-16 Tiller Road, London, United Kingdom, E14 8PX. The nature of business is defined as “Activities of real estate investment trusts”. The person with significant control is Mr Derrick Safiye Ali, also known as Derrick William James Devonport.

- Forex Capital Markets SA Limited

Forex Capital Markets SA Limited was incorporated on July 10, 2017, with its registered office address being Docklands Business Centre 14-16 Tiller Road, London, United Kingdom, E14 8PX. The nature of business is defined as “Activities of real estate investment trusts”. The person with significant control is Mr Kishen Kumar Bhantoo.

We cannot claim that these entities have anything to do with any FXCM business. FXCM typically reports the full list of its subsidiaries in its annual report that it files with United States Securities and Exchange Commission (SEC). These companies were registered after the latest such report was filed so we have no solid information on whether they are in any way related to FXCM.

There is a small chance that the use of these names is pure coincidence. There is a small chance that someone liked the name and decided to make use of the brand popularity.

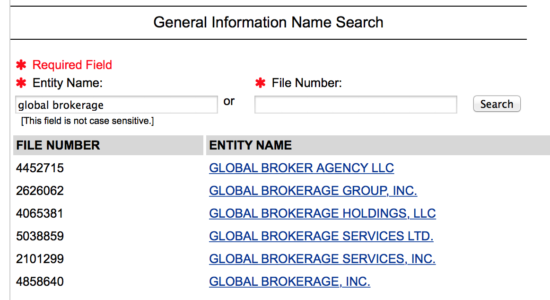

Also, let’s note that “Global Brokerage” is a wide-spread designation. Moreover, when FXCM Inc changed its name to Global Brokerage Inc it was not the single company to use “Global Brokerage” in its name.

FinanceFeeds’ search within the database of the Delaware Business register shows there are several companies using “Global Brokerage” in their names. It could be one of the risks associated with having a common combination of words in the business name.