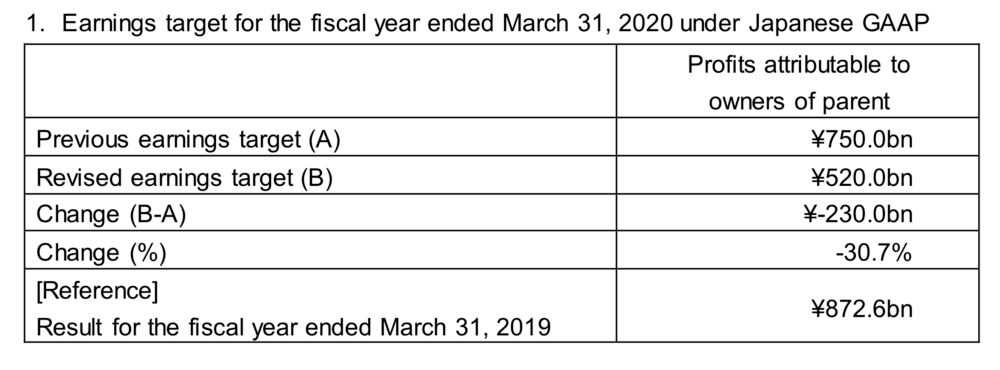

MUFG revises FY 2020 earnings target downward by ¥230bn

MUFG has revised its earnings target for the fiscal year ended March 31, 2020 downward by 230 billion yen to 520 billion yen.

Mitsubishi UFJ Financial Group Inc (TYO:8306), or MUFG, today announces that it has revised its target for profits attributable to owners of parent for the fiscal year ended March 31, 2020.

As announced on March 31, 2020, in the consolidated financial statements for the fiscal year ended March 31, 2020, a one-time amortization of goodwill (130.5 billion yen) is planned associated with an impairment loss on shares of Bank of Ayudhya Public Company Limited , a consolidated subsidiary.

At the same time, the volatile market movements in the fourth quarter are expected to have an impact on profits attributable to owners of parent company of approximately ¥65 billion due to impairment of shareholdings and a one-time amortization of goodwill associated with the impairment loss on shares of equity-method affiliates.

In addition, the recording of provisions for some credit in light of the impact of the COVID-19 pandemic is expected to have an impact of approximately ¥35 billion on profits attributable to owners of parent.

As a result, MUFG has revised its earnings target downward by ¥230 billion to ¥520 billion.

Let’s recall that, earlier this year, MUFG revised its earnings target too. The change was ¥150 billion and reflected an extraordinary loss of ¥207.4 billion due to the one-time amortization of goodwill associated with an impairment of PT Bank Danamon Indonesia, Tbk. Stock. The loss was recorded in the consolidated financial statements for the third quarter of the fiscal year ending March 31, 2020 under Japanese GAAP.

Year-end dividend forecasts for the fiscal year ended March 31, 2020 (fiscal year-end 12.5 yen per share, total 25.0 yen per share) are unchanged.