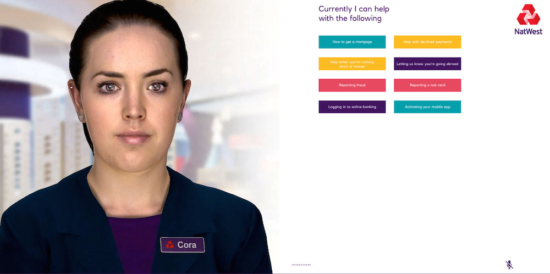

NatWest embraces AI, starts testing “digital human” Cora

A new Cora prototype has been built to include a highly life-like digital human that customers can have a two-way verbal conversation with.

NatWest has started testing a digital human driven by artificial intelligence (AI), in a move that underlines the invasion of new technologies in the financial services sector. The bank has announced that Cora, an AI powered ‘digital human’, could in future be used as an additional way for customers to get answers to basic banking queries such as “How do I login to online banking?”, “How do I apply for a mortgage?” and “What do I do if I lose my card?”.

The bank, has since the start of 2017, rolled out a text-based chat bot called ‘Cora’ that can answer 200 basic banking queries and now has 100,000 conversations a month with customers of the bank. But the bank has taken another step and, drawing upon advances in neuroscience, psychology, computing power and artificial intelligence, a new Cora prototype has been built to include a highly life-like digital human that customers can have a two-way verbal conversation with on a computer screen, tablet or mobile phone.

NatWest have been developing Cora using technology provided by New Zealand-based company Soul Machines. The latter uses biologically inspired models of the human brain and neural networks to create a virtual nervous system for their digital humans that can detect human emotion and react verbally as well as physically, through facial expressions. The bot is trained when dealing with new subject matter and when she makes mistakes she learns, so that over time the interactions become more and more accurate.

NatWest will deploy the technology if it successfully completes a pilot. At this point, it is thought it could be used to help free up time for human advisors to answer more complex customer questions and could also be used to answer queries which fall outside normal working hours and days.

Testing to date has highlighted some of the advantages of Cora. For instance, customers that have avoided digital services in the past may be more inclined to interact with digital humans like Cora. Also, she could help blind and partially sighted customers who are unable to engage with visual content.

The step taken by NatWest is in line with a broader trend of increased use of digital assistants by financial services companies. Digital Nordic bank Nordnet, for example, announced that it enrolled its first digital employee – Amelia, back in the summer of 2017, with the bot working side by side with her human colleagues in the customer relations department. Her first role has been to support new customers through the onboarding process and help them with tasks such as account activation.

Commenting on the employment of Amelia, Nordnet’s CEO Peter Dahlgren emphasized that it is AI that is capable of meeting the individual needs of each customer and this has been the primary reason for investing in the adoption of Amelia. Furthermore, he noted, Amelia’s colleagues will be able to dedicate more time to activities that have more value. As a result, “humans can focus on what humans do”.