New version of Spotware cTrader app introduces Sparkcharts

Sparkcharts allow traders to instantly get an overview of market dynamics.

Fintech expert Spotware Systems continues to update its mobile solutions. The company has just released a new version of its cTrader mobile app for iOS- and Android-based gadgets.

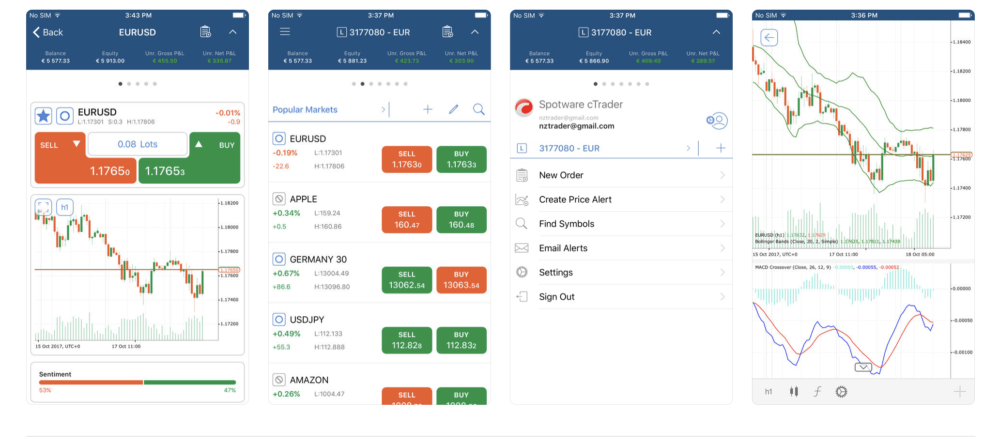

The new version of Spotware cTrader app is now even more informative thanks to the addition of Sparkcharts.

Sparkcharts allow traders to instantly get an overview of the market dynamics. Located in Watchlist, the first app screen, these charts show the price change over time per symbol. Users of the app can select the preferred time period, which is the past hour, day or week, from Settings.

The newest version of the cTrader mobile app is released less than a month after the preceding update which enabled traders to create orders in one click directly from the chart in full-screen mode. When the chart is open in full-screen mode traders can click the “New Order” icon and the “Buy”/”Sell” button will appear.

This feature is very convenient as it allows traders to conduct their technical analysis and trade from the same screen thus improving the overall app usability.

Let’s recall that, in another of the preceding versions of cTrader Mobile Beta, the app introduced extra functionality for charting and order creation. For instance, in addition to previously introduced horizontal, vertical or trend lines, in cTrader Mobile 3.1 traders got the ability to also draw Ray, Equidistant Channel, and Fibonacci Retracement on charts. That version of the solution also added more personalization options allowing traders to choose preferred color, width, and dash for their drawings on charts.

Version 3.0 of the solution provided support of user drawings on charts. On top of that, that version enabled traders to personalize their charts by choosing the preferred color of indicators. Chart zoom was also enhanced, so that traders can see the whole picture as the app allows to zoom out of charts 3-4 times further compared to the previous version.