NFA implements permanent bar on FXCM

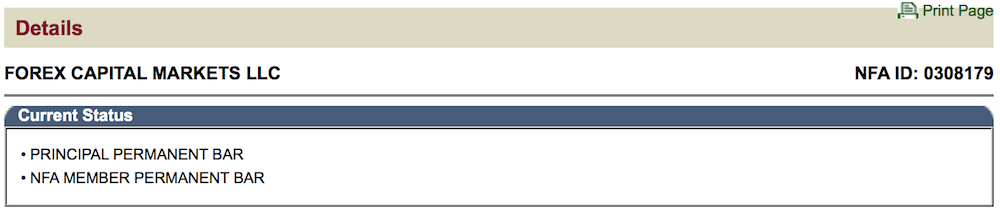

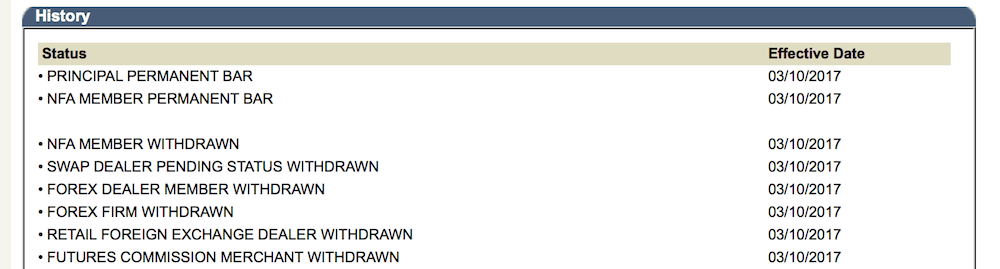

With effect of March 10, 2017, the United States NFA imposed permanent member and principal bar on Forex Capital Markets LLC.

It’s official! FXCM is no longer a part of the US market, after the United States National Futures Association (NFA) implemented a permanent bar on the broker.

As per the latest data in the NFA database, Forex Capital Markets LLC has a principal permanent bar and an NFA member permanent bar against its name.

Also with effect from March 10, 2017, FXCM has six US registrations withdrawn, including (inter alia) the ones as Forex Dealer Member, Forex Firm, Retail Foreign Exchange Dealer, and Futures Commission Merchant.

Earlier this week, on March 9, 2017, Drew Niv and William Ahdout officially abandoned their NFA registrations, following settlements with US regulators in February this year.

The US regulatory findings have shown that FXCM has misled its customers and regulators about its (No) dealing desk model. The findings alleged that the broker had traded against its clients for a number of years, while providing false information to authorities and clients. The resulting settlement led to bans on NFA and CFTC membership for FXCM, as well as for three of the company’s principals.

More than a month after the settlements were reached, FXCM.com is like a landing page, redirecting to non-US subsidiaries of the broker, including to Bermuda-registered unregulated division FXCM Markets. All mention of Forex Capital Markets LLC has been removed from the webpage.

The US retail FX accounts of FXCM have been transferred to Forex.com, the retail FX division of GAIN Capital. Both FXCM and GAIN Capital have confirmed the successful transfer of 47,000 accounts but questions around the trading activity of the newly acquired customers are still open. And it is this trading activity that will determine the price GAIN will pay for the acquisition.

On February 27, 2017, about three weeks after the regulatory revelations about FXCM became public, FXCM Inc changed its name to Global Brokerage Inc (NASDAQ:GLBR) and started trading under a new ticker on NASDAQ.