OANDA Corporation refines hedging on its proprietary fxTrade platform; continues sophisticated ethos

OANDA Corporation’s new v20 upgrade to its proprietary fxTrade retail platform further refines the hedging facilities, yet sticks firmly to the professional platform approach of ensuring sub accounts are opened and trades are offset

Technology-led Canadian multi-asset electronic brokerage OANDA Corporation has now made the facility to hedge available within its own proprietary trading platform, fxTrade with the company’s deployment of version 20 of the system.

Previously, OANDA’s customers wishing to utilize what many retail customers have come to accept as hedging facilities were firmly rooted to the MetaTrader 4 platform which had been launched across several global markets by OANDA over quite a long period of time and offered alongside its fxTrade platform.

As far back as 2008, OANDA Corporation offered the ability to hedge for clients in its domestic North American market via its proprietary system, but indeed at that time the functionality was to offset rather than hedge.

Traders who opened positions in an opposite direction effectively had their trades canceled because OANDA Corporation treated hedging exactly as what it really is – an offset. The company’s sophisticated commerical ethos adminarbly did not take advantage of the lack of experience inherent in customers new to trading, instead making traders who wanted to hedge open a sub account.

Hedging via the traditional method that many retail traders had become used to was available via MetaTrader 4, with fxTrade offering that element of sophistication generally reserved for professional platforms.

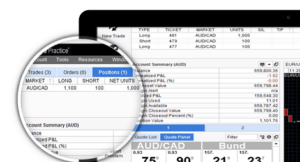

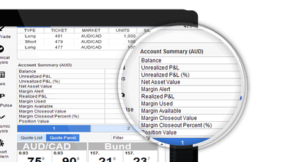

Now, with the firm’s new version of fxTrade, when trading with a v20 Hedging account, traders can open long and short trades on any instrument via fxTrade, MT4, and fxTrade Mobile trading platforms and has majored on providing visible details on the user interface that make it easy for traders to view P&L, margin and hedged positions.

Setting up a v20 Hedging Account

To begin opening hedged trades, traders first need to create a new v20 Hedging sub-account, which can be done very easily by checking a box for v20 Hedging during the account creation process.

Viewing Hedged Positions

While signed in with a v20 Hedging account traders can view any and all long and short trades within the trades section of your platform. Positions will be reflected as a single, net position per instrument.

How Margin Will Be Calculated

Margin will be calculated based upon the largest side of a hedged position (also known as the “longest leg”). This will impact maximum trade sizes and how close a traders account is to triggering a margin closeout.