OANDA upgrades Advanced Trader program to include cash rebates

Clients can now earn rebates up to $15 per million based on their deposits and monthly trading volumes.

OANDA Corporation has upgraded its Advanced Trader loyalty program in the US to offer high-volume clients the option of cash rebates. With an OANDA Advanced Trader account, clients can now earn rebates up to USD15 per million based on their deposits and monthly trading volumes. Alternatively, traders can opt into OANDA’s core pricing model and choose to reduce their commission fees by up to USD15 per million instead, offering greater flexibility than ever before.

David Hodge, Chief Revenue Officer OANDA explained, “The US market is sophisticated and competitive, and smart traders are constantly on the lookout for better pricing and greater flexibility. As such, we believe our new Advanced Trader loyalty program clearly demonstrates OANDA’s ongoing commitment to addressing the needs of our clients and helping them become successful self-directed traders.”

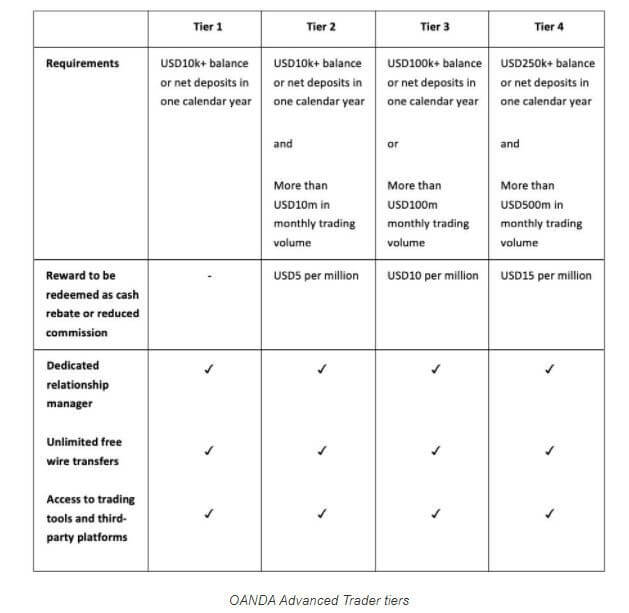

Featuring a tiered approach, the Advanced Trader program houses four distinct levels that afford a host of benefits to clients based on their monthly trading volumes and deposit levels.

Regardless of tier, Advanced Traders will continue to enjoy personalised support from a dedicated relationship manager, unlimited free wire transfers, access to advanced trading tools and third-party platforms, and more.