Plus500 forecasts 2019 profit to be below market expectations

Average user acquisition costs jumped 97% in 2018, whereas the regulatory changes in Europe are set to weigh on profitability in 2019.

Online trading company Plus500 Ltd (LON:PLUS) has earlier today posted its preliminary results for the year to the end of December 2018. As marketing spending rises, and regulatory climate in Europe sours, the outlook is not particularly positive.

The company stated:

“Following our latest assessment of the impact of the ESMA regulatory measures, FY19 revenue is expected to be lower than current market expectations. This, combined with our intention to maintain our marketing spend, is likely to result in 2019 profit being materially lower than current market expectations”.

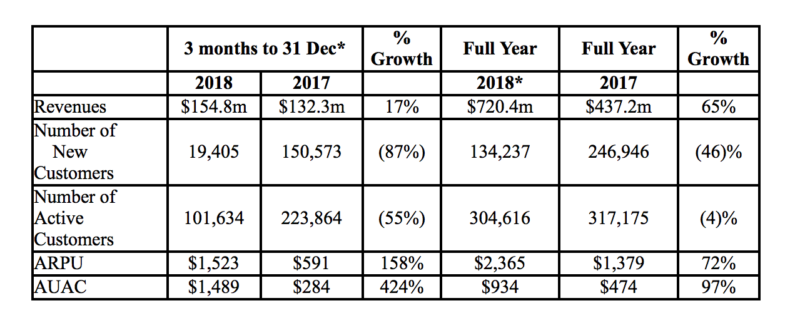

As indicated in Plus500’s third-quarter report, its average user acquisition costs (AUAC) are on the rise. The annual report showed a marked rise in AUAC. For 2018, average user acquisition costs reached $934, up 97% from the previous year.

During the three months to December 31, 2018, AUAC reached $1,489, up 424% from the year-ago quarter. The final quarter of 2018 also saw a 55% drop in the number of active customers, whereas the number of new customers was down 87%.

On the brighter side, Plus500 registered 65% rise in revenue in 2018 at $720.4 million (2017: $437.2 million), whereas EBITDA was up 95% at $506.0 million (2017: $259.2 million).

2018 included an exceptional first quarter (revenue: $297.3 million), following the record customer acquisition at the end of 2017, which was enabled by the considerable investment in back-office technology, procedures and regulatory compliance. The second half of 2018 was subject to a combination of extreme variations in market volatility and weak customer trading performance. In addition, retail customer revenue in the EEA region was significantly impacted by the ESMA regulatory measures.

The total number of transactions in 2018 increased by 6% compared to the prior year.