Saxo Bank releases new OpenAPI version, transition to new FX Order types gets completed

In an effort to simplify order placement for FX instruments, Saxo’s OpenAPI is transitioning from one set of stop orders to another set of stop orders.

Multi-asset trading expert Saxo Bank has just rolled out the latest version of its OpenAPI, with the transition to new FX Order types now fully completed.

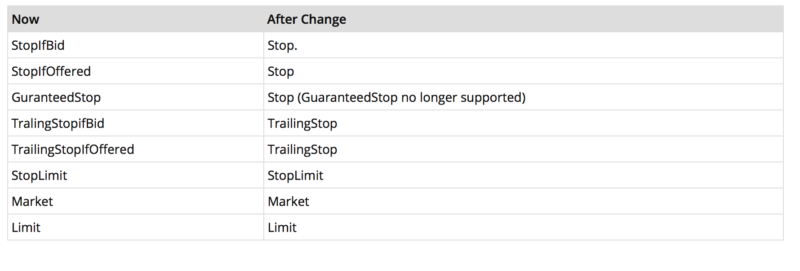

In an effort to simplify order placement for FX instruments, the API is transitioning from one set of stop orders to another set of stop orders. The change only affects FxSpot.

Before the change the list of available order types for FxSpot included:

- For non-DMA trades: StopIfBid, StopIfOffered, TrailingStopIfBid, TrailingStopIfOffered and StopLimit, Market and Limit;

- For DMA trades: GuranteedStop,TrailingStop, StopLimit, Market and Limit.

After the change, the list includes only: Stop,TrailingStop, StopLimit, Market and Limit for both non-DMA and DMA trades.

As a developer you will not see a change in the list of PlacableOrderTypes enum. But once the transition is made, you will find that the list of “SupportedOrderTypes” returned for an instrument, when calling ref/v1/instruments/details will be modified to only return Stop, TrailingStop, StopLimit, Market and Limit. In other words the values of StopIfBid, StopIfOffered, TralingStopIfBid, TrailingStopIfOffered and GuaranteedStop, will no longer be returned for FxSpot.

Under further changes released in the latest version of the API, an order will retain the same order id, even if the order is filled over several exchange sessions. This change will make it easier to keep track of an order and the position or positions created as the result of the order being filled.