Saxo Bank releases new version of OpenAPI for Excel

Version 1.0.1 of the solution includes a much-needed UI update, as well as a new functionality in the form of an About button.

In line with FinanceFeeds’ previous reports about more enhancements coming to Saxo Bank’s OpenAPI for Excel, the developers team today announces the release of version 1.0.1 of this solution.

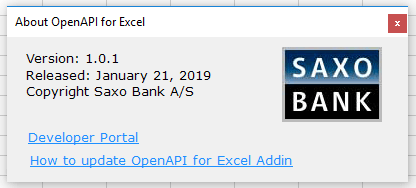

With the start of 2019, a much-needed UI update has been rolled out, along with a new functionality in the form of an About button, with helpful links to the developer portal and the version number of the add-in.

- Enhancements

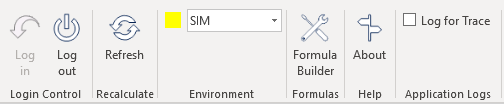

Brand new buttons – All buttons on the OpenAPI tab have been refreshed and blend in with the general aesthetic of Excel.

About button – To enhance user experience and quickly check which version number is running on one’s machine, a new button has been added to OpenAPI for Excel, which displays all relevant info and provides links to Saxo’s developer portal. This will be especially helpful as the team is planing to release many smaller iterations over the coming period.

UI text updates – Inconsistencies in the UI have been removed as much as possible in this iteration. There will however be more updates later as the developers team applies the styling conventions of the OpenAPI to this Excel product.

Bug fixes & improvements

- The Formula Builder button will now be disabled until the user logs in.

- The add-in’s log file no longer contains incorrect logging information concerning certificate warnings.

- Using the Formula Builder to create a subscription to the /positions/ endpoint will no longer deliver incorrect parameters to the OpenApiSubscribe() function.

- Minor updates to logging functionality.

Let’s recall that Version 1.0.0 of Saxo’s OpenAPI for Excel was released in August 2018. This first full release of Saxo’s OpenAPI for Excel included numerous enhancements to usability, especially for the Formula Builder, and ironed out a couple of inconsistencies that affected earlier versions such as uninformative error messages.

The version was re-released version in December 2018 when it was signed with a fresh certificate (valid until November 30, 2020) to prevent errors from the Microsoft Excel Trust Center.

You can find out more about Saxo Bank’s OpenAPI by visiting the dedicated Developer Portal.