SEC brings 862 enforcement actions in FY2019

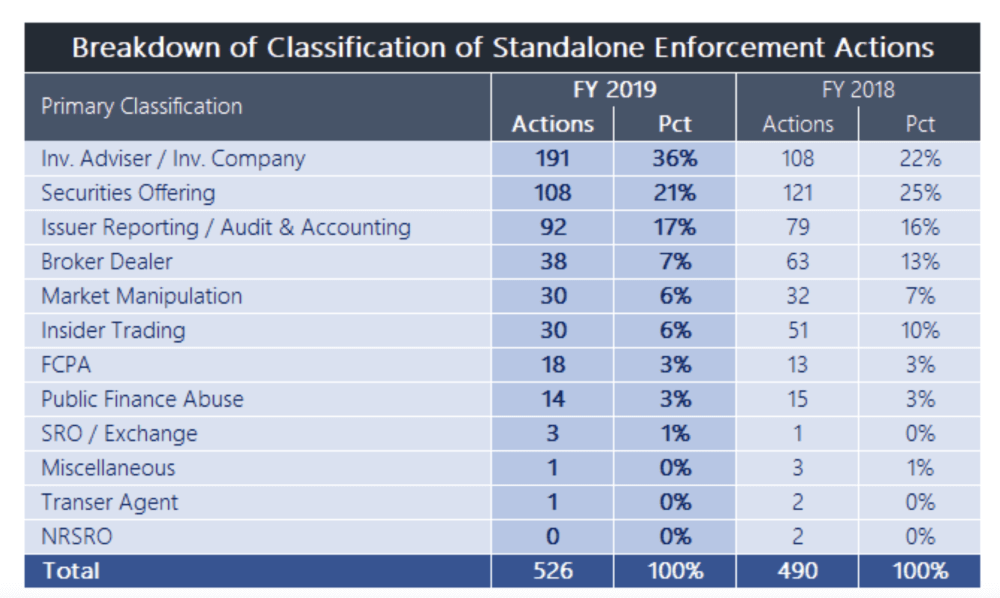

The majority of the SEC’s standalone cases in FY 2019 concerned investment advisory and investment company issues, securities offerings, and issuer reporting/accounting and auditing matters.

The Enforcement Division of the United States Securities and Exchange Commission (SEC) has earlier today published its Annual Report for Fiscal Year 2019.

During FY2019, the Commission brought a a total of 862 enforcement actions, of which:

- 526 were “standalone” actions brought in federal court or as administrative proceedings;

- 210 were “follow-on” proceedings seeking bars based on the outcome of the SEC’s actions or actions by criminal authorities or other regulators; and

- 126 were proceedings to deregister public companies (typically microcap) that were delinquent in their Commission filings.

In line with the prior fiscal year, the majority of the SEC’s 526 standalone cases in Fiscal Year 2019 concerned investment advisory and investment company issues (36%), securities offerings (21%), and issuer reporting/accounting and auditing (17%) matters. The SEC also continued to bring actions relating to broker-dealers (7%), insider trading (6%), and market manipulation (6%), as well as other areas such as FCPA (3%) and Public Finance (3%).

Notably, the SEC’s Division of Enforcement investigated and recommended a number of cases involving distributed-ledger technology and digital assets this year.

While the Commission says it continues to pursue issuers suspected of fraudulent conduct, Enforcement also investigated and recommended a number of non-fraud matters, including some featuring resolutions designed to bring issuers into prospective compliance with the securities laws. Three settled actions charging ICO issuers with violating the registration requirements of the Securities Act included innovative undertakings that establish a framework for future resolutions in this space. The settling ICO issuers agreed to establish claims processes for harmed ICO investors, to notify the investors of their right to file claims, to register their tokens with the Commission under Section 12(g) of the Exchange Act, and to comply with applicable registration and reporting requirements.

The SEC also took a number of actions against third parties that violated the federal securities laws through their participation in the offer, sale, or promotion of digital asset securities. These cases included charges under the anti-touting, broker-dealer registration, and exchange registration provisions of the securities laws.

In Fiscal Year 2019, the SEC obtained significant monetary remedies in enforcement actions. Parties in the Commission’s actions and proceedings were ordered to pay a total of $3.248 billion in disgorgement of ill-gotten gains. Penalties imposed totaled $1.101 billion. Total monetary relief ordered in Fiscal Year 2019 was $404 million higher than in Fiscal Year 2018, an approximately 10% increase.