Swissquote’s Pulse grows out of Beta phase

About a year after its beta launch, Swissquote’s social network re-emerges without the “Beta” sign next to its logo.

Swissquote Group Holding SA (SWX:SQN) has made the next step towards providing the trading community with an environment where one can share ideas, ask questions and may get to know the latest news about the market and the company.

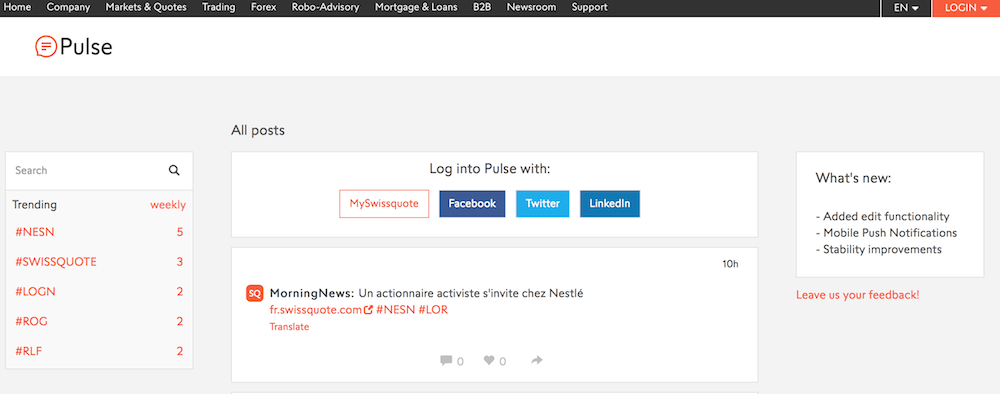

Swissquote’s Pulse, the social network for traders, has apparently grown out of its “beta” phase, as the service re-emerged today without the “beta” sign next to its logo. The change happens about a year after the beta-launch of Pulse, which was humbly announced by Swissquote on its Facebook page in August 2016.

Obviously, the network has attracted the interest of traders and, thus, has justified its presence on Swissquote’s website. Apart from sharing ideas, traders often use the network to provide feedback about Swissquote’s services and to suggest improvements. Overall, the tone of communication on Pulse is friendly and suits those who’d like to get information from the company or other traders in a less formal way.

Pulse is available in four languages – English, French, German, and Italian. It is open to those who do not have a trading account with Swissquote too – they can log in via Facebook, Twitter or LinkedIn.

Pulse became available on iOS devices in version 6.2.0 of the Swissquote mobile app, and several months after that the network was introduced on Android devices.

While we are discussing the topic of the social aspect of trading and mobile technologies, let’s mention that users of the Swissquote Mobile Banking and Trading Solution can now get notifications when they pass near a Swissquote Lounge. The lounges provide traders with the opportunity to get to know the company and the trading community better. In the lounges, traders can obtain direct stock market information in a friendly atmosphere, read the financial press, find out more about the company’s services or simply relax and enjoy a cup of coffee.