TD Ameritrade adds thinkorswim Web to suite of platforms

Retail traders can now access thinkorswim equity and derivative trading from any modern internet browser.

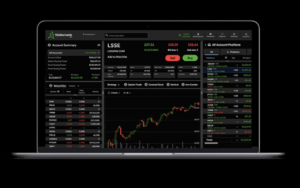

TD Ameritrade is expanding the range of platforms available to its clients. The company is bringing its thinkorswim trading platform to the web browser with thinkorswim Web, a new addition to the thinkorswim suite of platforms. Retail traders can now access thinkorswim equity and derivative trading from any modern internet browser on a new streamlined platform.

Steve Quirk, executive vice president of Trading and Education at TD Ameritrade, explains: “Thinkorswim Web offers the most widely used features of thinkorswim and is designed to complete the thinkorswim experience, be it on desktop, web or mobile.”

Highlights of the online platform include:

- Clean interface: Functionality most critical to a trade is placed front-and-center, allowing for quicker, more intuitive trading.

- Preconfigured trade strategies: Set up any trade, from a simple stock trade to a multi-leg options trade, with one click of a button.

- PaperMoney®: Test out new trading strategies risk-free with thinkorswim’s popular stock market simulator.

Amid unprecedented volatility, TD Ameritrade is fulfilling its clients’ desire to access thinkorswim technology with a fully synchronized experience on any device, wherever they may be. According to a survey conducted by The Harris Poll on behalf of TD Ameritrade, 60% of traders say they need access to their trading accounts 24 hours a day, seven days a week. This need may cause friction for traders in households where family members have to share computers or mobile devices more than usual, making the ease of a web-based platform even more important.

Amid unprecedented volatility, TD Ameritrade is fulfilling its clients’ desire to access thinkorswim technology with a fully synchronized experience on any device, wherever they may be. According to a survey conducted by The Harris Poll on behalf of TD Ameritrade, 60% of traders say they need access to their trading accounts 24 hours a day, seven days a week. This need may cause friction for traders in households where family members have to share computers or mobile devices more than usual, making the ease of a web-based platform even more important.

The online trading platform is also available to TD Ameritrade clients in Hong Kong and Singapore.