TD Ameritrade mobile app beefs up work with watch lists

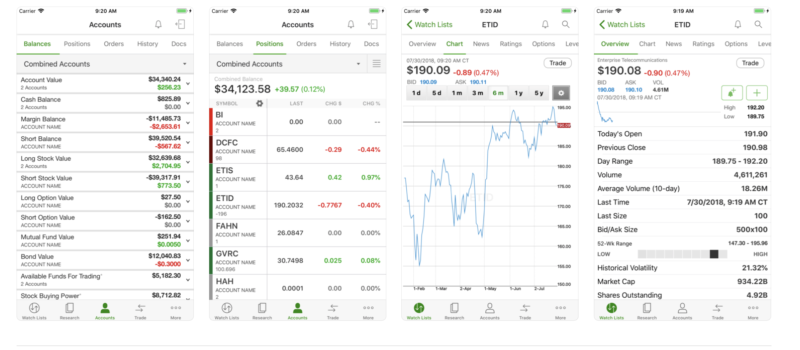

Traders can place data columns in any order they’d like and sort data columns by tapping the column headers.

TD Ameritrade has recently released a new version (5.2) of its mobile app for iOS-based devices with the latest set of improvements focused on watch lists.

In the newest version of the app, traders get to customize their watchlists. For instance, they can display more than 45 new data points. Furthermore, traders get to place data columns in any order they’d like and to sort data columns by tapping the column headers. Traders can also view data definitions and add up to 300 symbols.

One can always switch back to the standard watch list view any time with one tap.

Let’s recall that, in one of its recent releases, TD Ameritrade Mobile introduced enhancements focusing on alerts. The app now offers its users to stay up to date on securities of interest by setting up price and volume alerts. The list of such alerts includes “close price”, “% change since previous close”, and “volume exceeds”. Traders can also filter alerts by “active”, “triggered”, and “canceled”.

The aim of TD Ameritrade Mobile is to enable traders to stay on top of their account wherever they are. They can access the essentials, including equity and options trading, streaming quotes, real-time balances and positions, fund transfers, and extensive news and research. The features include real-time streaming quotes, as well as Level II quotes. Traders can view and customize their Positions display, and monitor real-time balances and positions.

Traders also get access to third-party research including analyst reports, as well as to on-demand streaming video from Thomson Reuters and CNBC. Social Signals and Twitter feed integration are also among the features of the app.

Regarding education, traders can browse videos on investing strategies, stocks, options, and exchange-traded funds (ETFs).

The regular updates to TD Ameritrade mobile solutions are hardly surprising given that the company has reported growth in mid-year mobile trading activity. TD Ameritrade’s mobile averages for the six-month period ended June 30, 2018 include:

- An average of 210,000 mobile trades per day;

- 24% of average client trades per day were mobile;

- An average of 7,300 new users per day;

- An average of 840,080 unique weekly logins.