TradeStation works on Ideastream project

The solution enables traders to get a group of cards, each identifying a particular opportunity, on a daily basis.

More projects continue to emerge from TradeStation Sandbox, a fintech accelerator and think-tank program, with the latest innovative solution in the works called “ideastream”. There is not much information about the project at this stage, but it is clear that the solution will allow traders to get ideas on a daily basis.

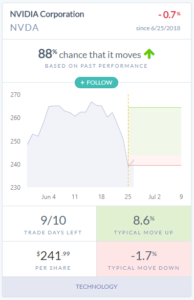

The company says that Ideastream uses the same technology leveraged by professional traders to identify trade opportunities, based on big data analysis of current and historical events and patterns.

The company says that Ideastream uses the same technology leveraged by professional traders to identify trade opportunities, based on big data analysis of current and historical events and patterns.

Each day traders get a group of cards, each identifying a particular opportunity. Traders then get to decide whether to trade immediately, or just Follow a card to see how performs.

Let’s note that TradeStation Sandbox’s list of active projects includes two more initiatives: EVA and Sandbot.

Eva harnesses the power of machine learning, AI and big data analytics, and aims to help traders connect events to opportunities. She (or it) enables traders to find, test, and trade sophisticated ideas born of quant-level analysis. EVA provides information on what to trade, when to trade and how to trade it. Exemplary questions in which EVA is an expert include “What happens to the S&P 500 when the Nikkei 225 is up 5% in a single day? ” or “How should I trade Apple before the ex-dividend date?”.

SandBot is an AI-based chatbot that helps traders find new trading opportunities while keeping them connected to the markets. It allows traders to get the price of a stock, ETF, or futures contract by entering a few key strokes. SandBot is also able to investigate an idea that interests a given trader. The bot will produce suggestions and the trader gets to decide which combination of symbols best meets his/her goals. For those who need more detail than just a quote, SandBot can quickly provide a chart so that traders can visualize recent trends.

TradeStation has been changing its image and offering in order to suit younger clientele. In July last year year, John Bartleman, President of TradeStation Group, announced that the company was undergoing a rebranding as it was seeking to cater for a growing clientele, including more millennials and younger traders.

“Today, we are taking technology into a new direction – with more mobile and web-based offerings, and go after a much broader audience of traders”, Mr Bartleman said back then.