TradingView enhances Account Manager functions for Forex.com clients

Thanks to the enhancements, traders can get more information about their positions.

Following the start of a very productive partnership with Forex.com, the retail FX brand of Gain Capital Holdings Inc (NYSE:GCAP), in February this year, TradingView, a popular charting resource for active traders, keeps expanding this collaboration.

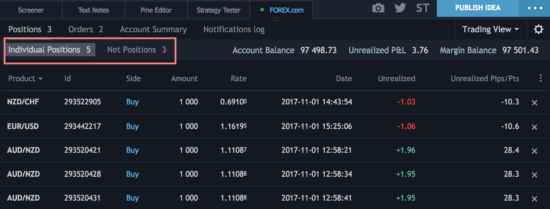

Today, the TradingView team announced a new functionality for those traders who use Forex.com as a broker, as a new tab was added in the Account Manager to let traders see Individual Positions.

The “Positions” tab includes 2 new subtabs now – Individual Positions and Net Positions. The difference between the short and long positions is calculated for each symbol in the “Net Positions” tab. “Individual Positions” tab displays each position as a separate trade and is opened by default. Also, two new columns have been added to the Individual Positions tab – ID and Date. The charts display Net Positions only, as before.

TradingView notes that if one’s brokerage account is regulated by the National Futures Association then Individual Positions can be viewed only. Traders may close Net Positions only.

In October, TradingView unveiled changes to the Customer Support service, bidding goodbye to emails dubbed to be things of the past. Instead, users can ask questions and report problems directly from the platform interface and receive timely replies right in the system. The point is to let the users avoid checking their inbox and stay focused. There is new ‘SUPPORT’ tab in traders’ TradingView profile. Every single ticket opened from this moment on is listed there and available for one’s review.

Talking of novelties at TradingView, let’s note that several days ago the company released the latest version of the Charting Library and Trading Terminal. For instance, a simple long/short position drawing tool enables traders to do advanced risk/reward calculations. This functionality is useful for those who wish to calculate their position size before executing a trade. Also, a number of popular technical indicators have been introduced, including Price Channel, Connors RSI, Moving Average Channel, Accumulative Swing Index, and EMA Cross indicator.