Typhoon approaching Hong Kong hampers launch of Northbound Investor ID Model

The launch is postponed as typhoon Mangkhut is expected to bring adverse weather to Hong Kong over the coming weekend.

Severe weather has hampered the plans for the launch of the investor identification model for Northbound trading (NB Investor ID Model) through the mutual stock market access program of Hong Kong Exchanges and Clearing Limited (HKEX) and the exchanges in Shanghai and Shenzhen (Stock Connect).

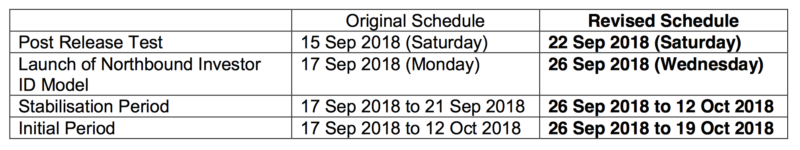

The launch of the model, initially scheduled for September 17, 2018, is now being delayed by more than a week. In an announcement published earlier today, HKEX explains that, with the approach of the Super Typhoon Mangkhut which is expected to bring adverse weather to Hong Kong over the coming weekend, to ensure the smooth implementation of the Northbound Investor ID Model, the launch date will be deferred to September 26, 2018 (Wednesday).

China Connect Exchange Participants (CCEPs) and Trade through Exchange Participants (TTEPs) are requested to note the following revised schedule in relation to the launch of the Northbound Investor ID Model. All other arrangements remain valid.

CCEPs and TTEPs are already allowed to submit the mapping data of Broker-to-Client Assigned Number (BCAN) and Client Identification Data (CID) for their clients. These entities are strongly advised to submit the mapping data as soon as possible, in order to allow sufficient time to rectify any error encountered during the registration process with the Mainland authorities.

CCEPs and TTEPs have to submit only production data to the secure file transfer protocol (SFTP) server. Submission of testing data to SFTP is strictly prohibited, HKEX warns.

Under the NB Investor ID Model, Exchange Participants (EPs) that offer Northbound trading services are required to assign a unique number in a standard format, known as the Broker-to-Client Assigned Number (BCAN), to each of their Northbound trading clients. They also have to provide Client Identification Data (CID) to HKEX, which will forward the information to Mainland exchanges. BCANs and CID – the two main components of the NB Investor Model – are for regulators’ market surveillance only.

Implementation of the NB Investor ID Model is poised to lead to more efficient Hong Kong-Mainland cross-border market surveillance.

Some companies have already sought to comply with the new requirements. In a notice on its website, Guotai Junan Securities (Hong Kong) Limited has informed its clients about the pending changes. The brokerage advises investors to complete, sign and return certain forms on or before September 13, 2018, as a written consent to provide personal data under Stock Connect in accordance with the Statement. Otherwise, the clients will not be allowed to place buy orders on T day, and the company would only be able to execute sell orders of their existing stocks holding under Stock Connect after the new model launches.