UK govt cannot confirm money from LIBOR fund used as intended

The LIBOR fund comprises massive £973 million but the National Audit Office report shows the UK government cannot confirm how the money was spent.

The London Interbank Offered Rate (Libor) continues to be on top of the agenda for the UK financial services sector, as well as for the public, given that the money from the Libor fund should go for good causes demonstrating best values.

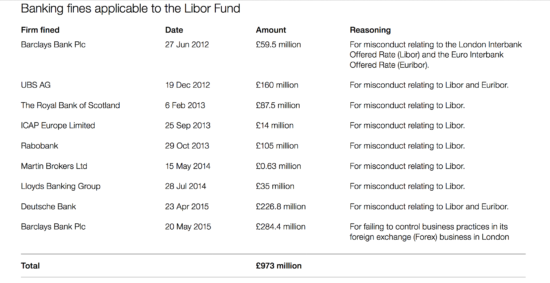

Today, the UK National Audit Office (NAO) published a report entitled “Investigation into the management of the Libor Fund”. The fund was set up after an international investigation beginning in 2012 into Libor revealed that several banks in the United States and the European Union, including the UK, had manipulated Libor for profit. UK regulators fined the banks a total of £688 million. In 2012, the then Chancellor pledged that “the multi-million pound fines paid by banks and others who break the rules will go to the benefit of the public and not to other banks”.

In 2013, an investigation was launched into allegations that dealers were manipulating exchange rates. Six banks were fined £6.3 billion in 2015. This included fines of £1.5 billion for Barclays by five international regulators, of which £284 million was issued by the UK’s Financial Conduct Authority. In June 2015 the Chancellor added this £284 million fine for manipulation of foreign exchange markets (Forex) to the Libor Fund. This brought the total available in the Fund to £973 million.

Due to questions raised by Parliament and the media about the transparency of how the money from the fines is being distributed, NAO launched an investigation to explain how the government has distributed the money.

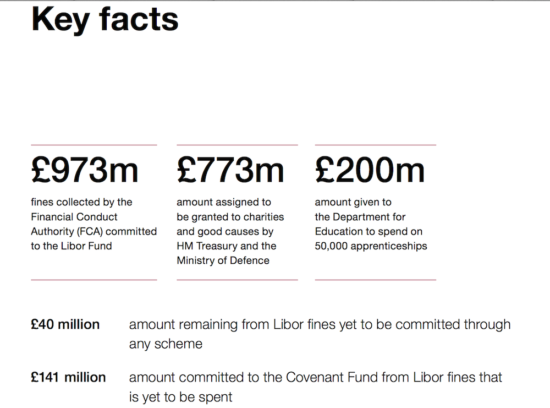

The NAO reports shows that up to September 2017 the government had committed £933 million of the £973 million. Here is a breakdown of the funds distribution:

- HM Treasury – £467 million;

- Ministry of Defence (MoD) – £266 million;

- Department for Education – £200 million.

The remaining £40 million of the fund is held by HM Treasury but has not yet been committed to any particular scheme.

The report makes some critical remarks. For instance, it is not clear whether the Department for Education used the Libor fund money to deliver apprenticeships, as promised. DfE has not pursued a specific policy to deliver apprenticeships to previously unemployed 22–24 year olds and it cannot demonstrate whether 50,000 new apprenticeships for this group have been provided. It is not possible to distinguish the impact of the £200 million Libor fund spending from the performance of the overall apprenticeship program.

Overall, the UK Government cannot yet confirm that all the money has been used as intended.

Moreover, the report notes the lack of clarity with respect to money distribution. The initial pledge that the money would support Armed Forces charities and good causes was later expanded in October 2014 to include “Armed Forces and emergency services charities and other related good causes that represent those that demonstrate the very best of values”.

There is no government directive that provides more detail about how the money is to be spent or what constituted ‘the best values’. Hence, the money is not ring-fenced and the government has been able to use the money for pretty much any government spending.