Will the FX industry condense via M&A in the way that 37 banks became 4 in just 2 decades? – Op Ed

If the early millenial years were the period during which the retail FX industry was in its infancy, the middle of the second Millennial decade can be considered to be the period during which the entire ecosystem which consists of platform vendors, liquidity providers, specialist software developers and retail electronic brokerages has flourished to a […]

If the early millenial years were the period during which the retail FX industry was in its infancy, the middle of the second Millennial decade can be considered to be the period during which the entire ecosystem which consists of platform vendors, liquidity providers, specialist software developers and retail electronic brokerages has flourished to a point in which it is now a highly established industry in its own right.

This fast-moving and technology-led sector of the business reached not only maturity but became one of the most global and profitable online businesses worldwide and when considering that the real growth period was between 2009 and today, that is remarkable progress.

With maturity comes the requirement to not only continue to keep pace with technological change and the demands of an ever more demanding client base ranging from end users to introducing brokers and representatives whose businesses have developed from small, revenue-share orientated one-man-bands that bore resemblance to the old affiliate websites of the late 90s, to fully integrated brokerage houses with portfolio managers and sophisticated systems, in many cases trading up to 90,000 lots per month and passing all of that revenue to retail FX firms across the globe.

The question is, will this continue, or is the age of consolidation upon us?

Signs of potential moves toward industry consolidation were shown as early as 2013, during which many successful FX companies that had not so long ago been regarded as startups moved very quickly toward becoming publicly listed on some of the world’s most prominent stock exchanges.

Teddy Sagi’s SafeCharge International Group Ltd (LON:SCH) made its way onto London Stock Exchange’s Alternative Investment Market (AIM) at the beginning of 2014 and now has a market capitalization of £372.8 million, shortly to be joined on the same exchange by Plus500 Ltd (LON:PLUS) which became recognized as a lesson in corporate efficiency, rising up to a value of over $1 billion by May 2015, ranking Plus500 as Israel’s most successful internet company ever to have existed.

London’s AIM has been the preferred choice of FX brokerages and FX related fintech companies that have morphed from startup to their status as firms with attractive stock to a public audience, however the ‘IPO fever’ has now subsided and given way to perhaps a more insidious corporate direction: Mergers and acquisitions.

In that same year, during which ultra-modern firms such as Plus500 were looking to list their stock, the large companies in the industry were busily engaged in the acquisition of various specialist components such as data analytics companies, the retail client bases of other brokerages in order to gain further economies of scale in specific regions, and negotiations between some of the largest companies in the industry around mergers, some of which came to fruition.

In late September 2013, GAIN Capital Holdings, Inc. (NYSE: GCAP) acquired GFT (previously Global Futures & Forex Ltd), about which GAIN Capital CEO Glenn Stevens said at the time “The acquisition of GFT will yield numerous benefits for our clients, partners and shareholders. The combined company boasts a deeper global footprint, a robust offering of more than 12,500 financial products, and industry-leading trading technology. We intend to use GFT’s broad product offering, innovative tools and educational capabilities to further strengthen our competitive position, while realizing significant synergies from combining the best of both organizations.”

Just one day before GAIN Capital’s acquisition of GFT, FXCM purchased specialist FX intelligence, market coverage and execution services company Faros Trading, a firm which it eventually sold to Jeffries Group LLC, a subsidiary of Leucadia, in April 2015.

FXCM has been very much a leading company among North America’s giants in terms of acquisitions, the company having purchased the MetaTrader 4 client base and assets of IBFX in the US and Australia in late 2014, just over a year before IBFX bowed out of the US market altogether and sold its entire client base that had remained on the proprietary Tradestation platform to OANDA Corporation this week.

In November last year, Teyu Che Chern, CEO of Singaporean futures giant Phillip Capital met with FinanceFeeds in New York to explain its foray into the North American retail market, an initiative that it began to implement by forging alliances with US exchanges CME and ICE, whilst ICE purchased Singaporean exchange SMX to execute cross border exchange-traded futures.

Whilst building economies of scale via acquisitions rather than organic growth is a natural step for large, well capitalized firms, it is worth remembering that even the giants within the industry are only approximately twenty years old, their progress having been remarkable within that relatively short timeframe, however the proliferation of smaller companies are now starting to go down this route too.

Switzerland’s Dukascopy Bank SA announced this year that in order to increase its presence in Australia, South Korea, South Africa and Canada, the company is now looking to acquire existing companies in those regions rather than via organic growth or provision of white label solutions to firms operating in the Far East and North America, a new step for the technology-led boutique company which in terms of revenues and corporate size is far smaller than compatriot Swissquote, which has bought MIG Bank and ACM over the last four years and completely integrated both entities into Swissquote’s organization under one brand.

Last week, CFH Group CEO Christian Frahm spoke to FinanceFeeds CEO Andrew Saks-McLeod

Rumors had begun circulating last week with regard to what had been widely misconstrued as a potential sale by CFH Group of part of its operations. FinanceFeeds can categorically state that this is absolutely not true, and indeed CFH Group is looking to strengthen its position further by engaging in acquisitions.

Mr. Frahm explained “We came out after the Swiss National Bank’s removal of the 1.20 peg on the EURCHF pair, and said at the time that this sector will consolidate. We brought onboard Dipak Rastogi who is one of the top people in the world on the mergers and acquisitions side, and have worked ever since to put in place an industry consolidation play.”

“This is what we are now executing, the acquisition of smaller players to put them under our umbrella” – Christian Frahm, Founder & CEO, CFH Group.

Recently, CFH Group enlisted Dipak Rastogi, CEO of Citi Venture Capital International as a non-executive director, alluding to private equity aspirations.

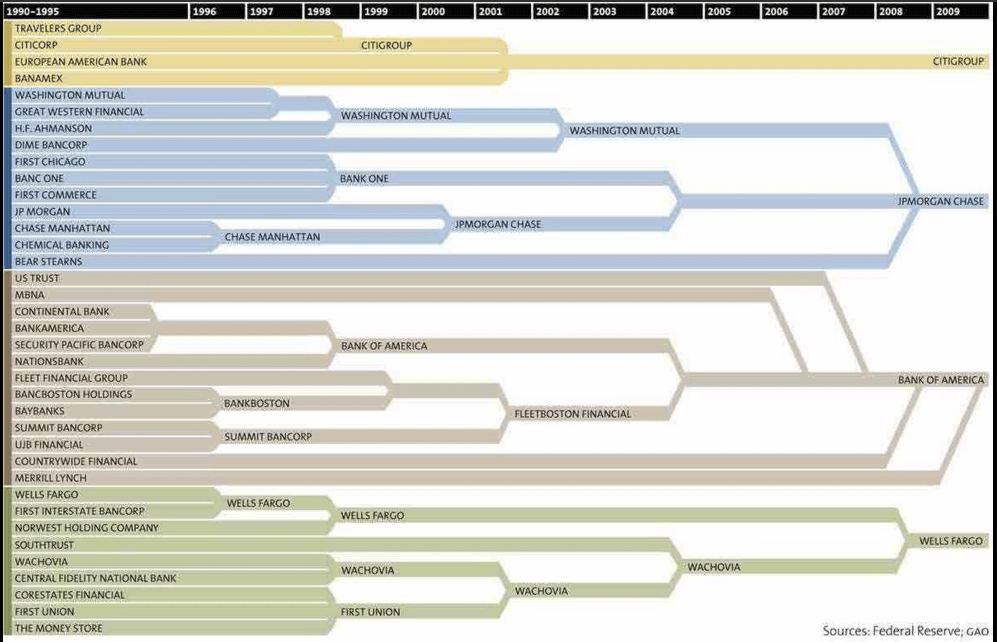

All of this activity most certainly gives the impression that mergers and acquisitions and growth by strategic purchases are on the agenda for many companies in the industry, and an interesting comparison is how this dynamic affected North America’s banking industry over the last two decades.

Of course, the FX industry is much newer and in many cases more modern and sophisticated than the traditional banking sector, however what was 37 different banks in the early 1990s is now just four. The question is, will the FX industry follow?

This chart shows the consolidation of America’s banks that has occurred over 25 years, turning 37 into just 4 entities.