Worldpay revises cost synergies forecast in light of post-merger integration with FIS

Based on the substantial progress toward completing post-merger integration, Worldpay now expects to achieve $250 million in annualized cost synergies by year-end 2019.

Payments technology company Worldpay Inc (LON:WPY) has earlier today posted its first quarter 2019 report, providing an update on how its deal with FIS is progressing.

Based on the Company’s substantial progress toward completing post-merger integration, Worldpay now expects to achieve $250 million in annualized cost synergies by year-end 2019, up from its previous expectation to achieve $200 million in annualized cost synergies by year-end 2020. In addition, Worldpay is increasing its in-year 2019 cost synergies forecast to $180-$190 million from $130-$140 million.

On March 17, 2019, Worldpay and Fidelity National Information Services, Inc. (FIS) announced that their boards of directors unanimously approved a definitive merger agreement pursuant to which Worldpay will combine with FIS. Following the closing of the proposed transaction, current Worldpay stockholders will own 47% of the combined company and current FIS shareholders will own 53% of the combined company, on a fully diluted basis. The proposed Merger is subject to customary closing conditions, including receipt of required stockholder and regulatory approvals, and is expected to close in the third quarter of 2019.

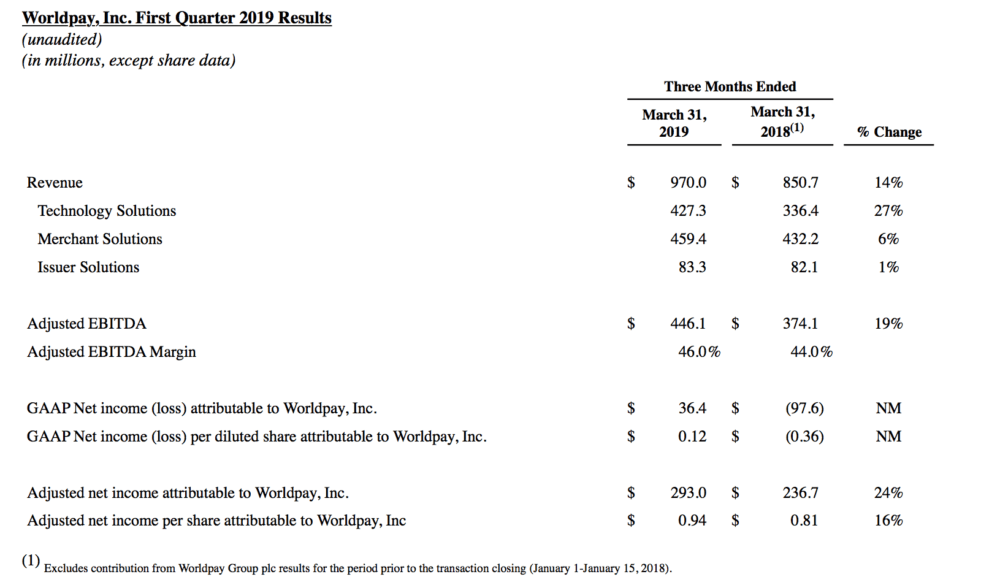

Regarding results for the quarter to end-March 2019, let’s note that revenue increased 14% in the period to $970 million as compared to $850.7 million in the prior year period. On a GAAP basis, net income per diluted share attributable to Worldpay, Inc. increased to $0.12 as compared to $(0.36) in the prior year period. Adjusted net income per share increased to $0.94 as compared to $0.81 in the prior year period.