Scotland’s illogical will to go free could benefit British FX & CFD brokers & traders – Op Ed

Nicola Sturgeon’s unrelenting wish to decimate her own national economy is causing confidence in M&A activities, a surge in the Pound and could be very good news for British brokerages with GBP as a base currency

You can do something for love. You can do something for money, but in some cases there is nothing quite so satisfying (and in most cases damaging) than doing something out of spite.

Many cases of this have been present across many commercial sectors over the years, from traditional manufacturing right through to today’s world of e-commerce and online financial markets.

Henry Ford, one of the most highly regarded industrialists in the world, who rewarded his employees highly and listened to customers constantly through research and development process of his company’s products, did not like Enzo Ferrari.

After a prolonged and ill-fated attempt at an acquisition, Henry Ford having had his time wasted by a peer whose traits were quite the opposite of his own, Enzo Ferrari being an egotistical, reclusive figure who only cared about winning races and whose business acumen was extremely questionable, the otherwise cool and calculated Henry Ford was furious. He returned to Detroit and instructed his design team to build a car that would trounce Ferrari at the famous Le Mans 24 Hour endurance race in France.

Ferrari had dominated at Le Mans for five consecutive years between 1960 and 1965, and Henry Ford knew that by putting an end to that reign, he would damage Ferrari’s notorious ego once and for all. From 1966 to 1969, Ford’s GT40, which was designed purely to win at Le Mans, held the winning slot, driven by famous names including Jacky Ickx and Bruce McLaren, elevating Ford Motor Company to the realms of absolute automotive competitive stardom, and casting the GT40’s history as one of the finest production and competition cars ever made.

Enzo Ferrari never recovered from the trouncing by a company which had not dedicated itself to motorsport but was instead renowned for making practical mass produced cars for transporting American families to and from work and school, Ferrari went bankrupt several times, and was bailed out by Fiat and the Italian government, whereas Ford Motor Company continued its rise to dominate the world’s public roads as well as racing circuits.

This analogy can be applied to the somewhat illogical will by Scotland to continue its endeavors toward becoming independent from the United Kingdom, under the auspices of staunch socialist Nicola Sturgeon, the leader of the Scottish National Party and the incumbent First Minister of Scotland.

Nicola Sturgeon’s cause echoes that of Enzo Ferrari. A resilient wish to be independent from completely aligned national and regional economies in surrounding areas, even though all of the economic factors and practical sensibilities of doing so would be not only counter productive but suicidal.

As is widely understood, I was, and still am, a committed supporter of Britain’s exit from the European Union, largely because England – and for England, read London, is not and never has been a European nation. London has never, and will never be a European city. It is a global powerhouse, the world’s largest financial center that is responsible for 49% of all international interbank order flow.

London’s financial services sector employs only 0.0009% of the entire working age population of the European Union, yet it is responsible for 16.2% of all European Union tax receipts. That is the very definition of efficient productivity and ingenuity.

London is an epicenter of technological prowess and business ethic. Europe is a socialist continent with no alignment to Britain. Britain’s trade peers of the future are Hong Kong, mainland China, Australia, Singapore, South East Asia, and North America. Countries with enormous productivity and leading edge business environments.

Scotland is being carried by London’s productivity, yet its provincial government wants to deal it a blow. The reality is, Scotland will deal itself a blow and the remaining parts of the United Kingdom will find that they have lost another expensive burden, adding to the removal of the burden of supporting the inert and corrupt European Union.

In the electronic trading industry, Europe plays no part. Germany and France have a relatively large retail customer base compared to other regions in the European Union, however neither can hold a candle to the US, Britain, China, Australia or South East Asia in terms of development of financial markets or modernity of technology, or mindset and online financial literacy of population. Absent from both nations is a retail brokerage of any consequence too, most traders in France and Germany are customers of British CFD companies.

As Nicola Sturgeon busies herself by hammering further nails into the coffin of the very nation over which she presides, the markets responded accordingly, with the FTSE 250 index having hit a record high today on mergers and acquisitions activity, and the British pound rising upon Ms Sturgeon’s announcement that a second referendum would be called on which Scottish voters could vote to leave the United Kingdom.

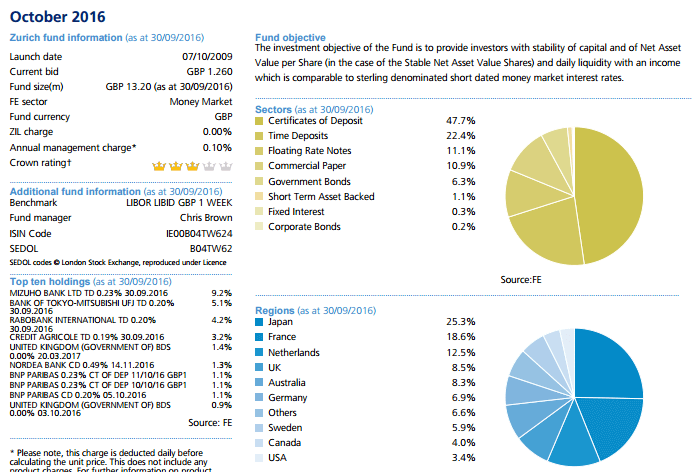

For many of the same reasons, in October last year, FinanceFeeds took a close look at how the GBP could become the number one currency post-BREXIT, and that liquidity of the British pound should be something that all firms should keep a keen eye on.

This applies to a more acute degree should Scotland jettison itself from its sponsor south of the border.

As of mid-2014, Scotland raised £53.1bn in 2012/13 and spent £65.2bn, leaving the country £12.1billion short. According to the Treasury, public spending in Scotland is higher than anywhere else in the UK apart from Northern Ireland. Explanations have included Scotland’s relative sparseness and its poor health.

Those wishing to bolster any notion of independence often cite Scotland’s oil industry as a mainstay, however even as far back as the mid 1990s, most drill platforms off the coast of Aberdeen were being operated by Conoco or Exxon, neither of which are Scottish companies, and a large proportion of petrochemical products made from crude oil derivatives from the North Sea are being made into pen lids in China rather than being refined into gasoline to supply domestic fuel stations.

Two years ago, the oil conundrum raised its head.

Quietly and without fuss, one of the key claims unionist economics, that Scotland is overly dependent on oil, has lost its menace.

The referendum battle lines on oil revenues were clearly drawn, oil price volatility was a vital unionist scare story. Supporters of Scotland remaining in the United Kingdom have often stated that Scotland’s economy is not viable without a steady $100 a barrel and that any fall in prices would herald an economic disaster.

Claims of ‘armageddon’, ‘cataclysm’, ‘black-holes’, ‘tax rises combined with massive cuts in services’ were all based on fears of $70 oil prices then considered to be the worst case scenario. Today $70 would be a desirable price for the industry – so outside of Aberdeen and the North East why hasn’t the sky fallen in? The reason is welfare dependency and continual sponsorship from Westminster, both ecomomic factors that, if removed, would boost the Pound’s value and further strengthen London’s independence as a powerhouse.

Today’s price for crude oil is $48.57 per barrel, a shadow of its former value and a massive problem for the oil-dependent economy of an independent Scotland.

Make no mistake, the oil price has fallen dramatically and now fluctuates between the mid $40s and high $60s a barrel, arguably beyond the worst case scenario predictable from historic data.

The low price is bad news for Aberdeen, the North East and the whole oil and gas sector. Tens of thousands of jobs are being cut as oil companies try to adjust to the price slump and every single job lost is a catastrophe for the individual concerned. There has also been a significant fall in Scottish Government revenues and, as a result, with Scotland’s annual notional operating deficit as of mid 2014 standing at 8.1% of GDP versus 5.6% for the rest of the UK.

Whilst multi-asset trading is very much on the agenda for most brokerages these days, and a genuine multi-product platform becoming an essential product offering, crude oil is not a commodity in which faith is being restored. Retail trading platforms are now connecting to venues such as DGCX in Dubai, as well as offering listed derivatives on CME in Chicago, most of which are equities and futures contracts on corporate stock, or precious metals which are massively popular among traders in certain buoyant regions in South East Asia.

Quite simply, should the referendum go in the direction that Ms Sturgeon would like this time around, British FX and CFD firms may well see demand for GBP-based pairs and GBP-based trading accounts increase remarkably.