Australians lose $21.4m to investment fraud in first 9 months of 2017

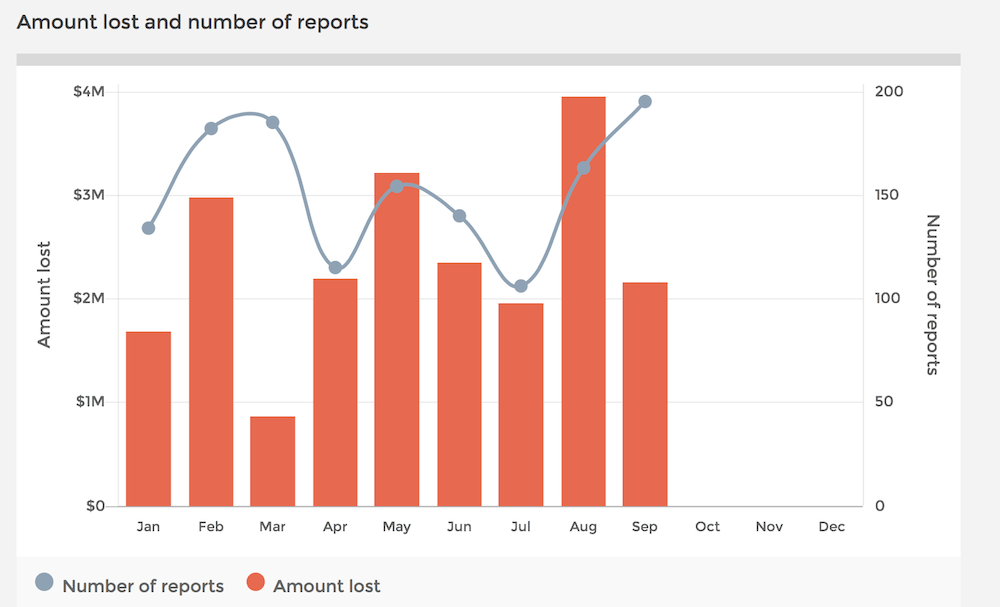

The amount of money that Australians reported lost to investment fraud in the January-September 2017 period was $21.36 million, with September marking smaller losses than August.

The amount of money lost due to the activities of investment fraudsters in Australia during the January-September 2017 period reached $21.36 million, according to the latest data from Scamwatch, a body operated by the Australian Competition and Consumer Commission (ACCC).

The total amount of money reported lost due to investment scams in Australia was $2.16 million last month, down from the record-high monthly losses of $3.95 million reported in August 2017. Let’s recall that the August record surpassed the previous record of $3.94 million in losses set in November 2015.

During the first nine months of 2017, ACCC received 1,374 reports of investment fraud, with people aged 55-64 losing most money due to such schemes. New South Wales residents were the most active in filing reports and were the ones suffering the biggest losses.

The numbers are not conclusive as many investors do not report their losses. In 2016, the ACCC and the Australian Cybercrime Online Reporting Network (ACORN) received a total of 200,103 reports about scams. Losses reported to Scamwatch, ACORN and from other scam disruption programs amount to approximately $300 million.

The police have also intervened to help tackle fraudulent activities. The Queensland Police, for example, have recently launched an “R U in Control?” campaign targeting fraud. The campaign seeks to help Queenslanders avoid becoming a victim of cyber and financial crime.

“We are also seeing vulnerable Queenslanders targeted daily with cold call investment scams, malicious emails and fake website scams,” Commissioner Stewart said.

The biggest part of the losses due to cold calling in 2016 related to offers of investment opportunities in binary options, according to ACCC’s annual report on scam activity for 2016.

Estimates, quoted by the Queensland Police, show that organised crime costs the Australian economy $21 billion per year with $8.5 billion of that figure directly related to cyber, identity and corporate crime.