FOREX.com mobile app enhances charting experience

The latest update improves the experience when using indicators on the charts, retaining the indicators when returning to the full screen charts for the same market.

FOREX.com, the retail FX business of Gain Capital Holdings Inc (NYSE:GCAP), has just rolled out a new version of its mobile app for iOS devices.

The most recent version of the solution improves the experience when using indicators on the charts, retaining the indicators when returning to the full screen charts for the same market. Further, a new chart profiles feature will allow chart layouts to be named and saved, then loaded on other markets.

In one of the preceding versions of the solution released in May, new TradingView charting was added, complete with more than 60 technical indicators, 10 chart types, as well as Compare function. Back in May, the City Index mobile app was also equipped with these new TradingView charting capabilities.

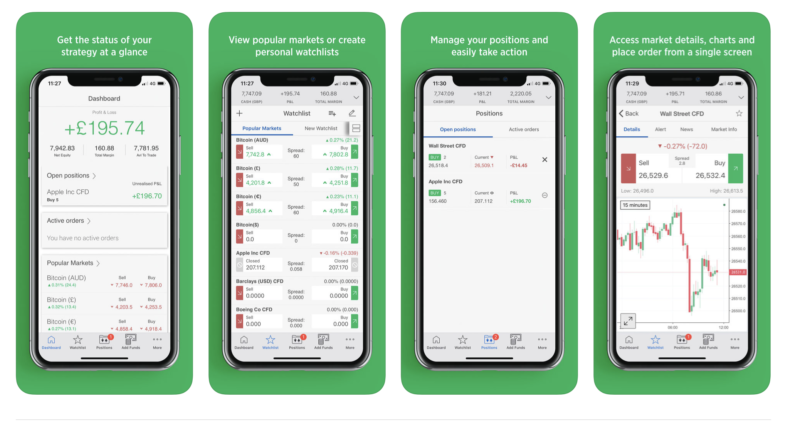

The FOREX.com mobile app enables trading of forex, indices, and commodities on the go. Users of the solution can access live quotes, interactive charts, market analysis, real-time news, customisable watch list and rate alerts.

Traders can access advanced charting features that include candlestick, bar, line, and mountain charts with technical indicators, historical data, multiple time frames and pinch-to-zoom functionality. The app also enables placing trades and viewing of positions and orders directly from the charts.

The comprehensive trade tickets include required margin and pre/post trade available equity.

Traders can also stay on top of market important events with comprehensive Economic Calendar.

The solution gives access to account management features like funding and withdrawals, as well as reporting tools.