FXCM Inc aka Global Brokerage Inc shares start trading under new ticker on NASDAQ

FXCM Inc, aka Global Brokerage Inc, Class A Common Stock now trades under GLBR ticker on NASDAQ.

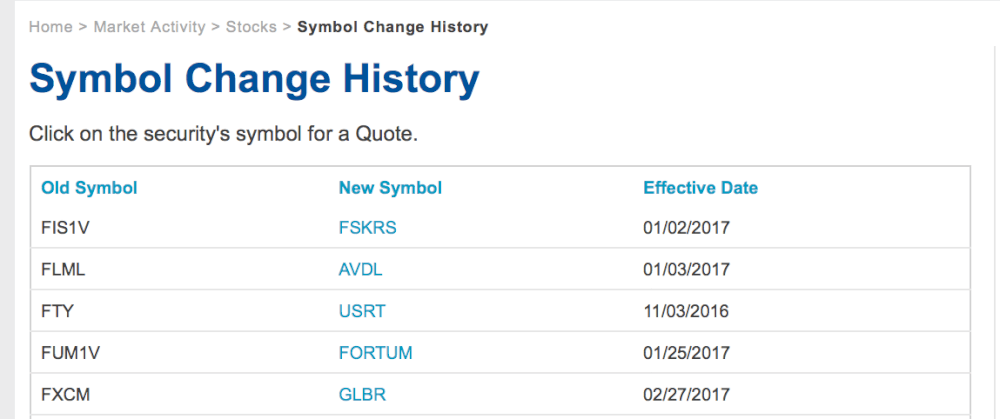

Global Brokerage Inc, formerly FXCM Inc, has its shares trading on NASDAQ under a new ticker – GLBR, effective as of today, February 27, 2017, at the opening of US market.

FXCM Inc initially unveiled its plans to rename to Global Brokerage Inc on February 21, 2017. That same day, the decision by the National Futures Association (NFA) to prohibit the broker and three of its principals from membership became effective. Along with the change of the name, the trading ticker symbol of FXCM Inc, aka Global Brokerage Inc, changes to “GLBR”, effective at the opening of trading today, February 27, 2017. FXCM’s Common Stock trades on the NASDAQ Global Market and the new CUSIP will be 37891B109.

Earlier today, the Investor Relations’ section of the broker’s website displayed the new logo of the company with its new name. The broker also published a SEC filing, including a scanned copy of an announcement by the Secretary of State of the State of Delaware, dated February 24, 2017, showing that the name “FXCM Inc” was changed to “Global Brokerage, Inc”.

Today also brought a long awaited piece of news from Leucadia National Corp. (NYSE:LUK), which back in January 2015 extended a $300 million lifeline to FXCM Inc, as the broker had to tackle the impact from the “Black Swan” events. In its financial report, Leucadia said that its maximum exposure to loss as a result of its involvement with FXCM was equal to the sum of the carrying value of the term loan ($164.5 million) and the investment in associated company ($336.3 million), which stood at $500.8 million at December 31, 2016.

At the end of last year, Leucadia had a 49.9% membership interest in FXCM and up to 65% of all distributions. Leucadia does not hold any interest in FXCM Inc., aka Global Brokerage Inc, the publicly traded company. Leucadia owns 49.9% in FXCM Group, LLC, and its senior secured term loan is also with FXCM Group, LLC, a holding company for all of FXCM Group, LLC’s affiliated operating subsidiaries.

There were no rescue announcements regarding FXCM in Leucadia’s report and letter to shareholders today. Instead, Leucadia admitted it was uncertain of the full extent of the consequences of the recent settlement between the US regulators and FXCM.