IG adds new features to web trading platform

More new features have just been introduced to the platform that was initially rolled out towards the end of 2016.

The IG Trading platform, the new web-based trading solution developed by the team of IG Group Holdings plc (LON:IGG), has seen the addition of some new features, set to improve the user experience.

The latest additions include enhancements to the news section, new ways of sorting open positions and beefed-up watchlists.

The latest additions include enhancements to the news section, new ways of sorting open positions and beefed-up watchlists.

Traders are now able to follow the most important stories of the day by clicking on the news tab from the left toolbar. They can also filter the stories by selecting the group they are interested in – for instance, index-related news or stories concerning shares.

Regarding the sorting of open positions, traders can now do this by Profit/loss. This happens as the broker is still working on introducing more “sort by“ features. Traders are also able to sort by name (alphabetically) by clicking on market.

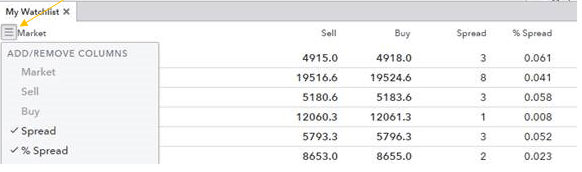

There also enhancements to watchlists. The spread and spread percentage can now be displayed from watchlists. Traders can add columns to watchlists and would be able to see spread and spread percentage per instrument by clicking on the menu button and then selecting the spread and spread % options.

IG Group has been regularly updating its web trading platform in line with feedback it gets from traders. In February this year, FinanceFeeds reported about enhancements to the platform and planned upgrades – these ranged from sound alerts to a darker color theme.

Talking of IG’s solutions for traders, we should also mention that, earlier in March, IG announced the release of online charting software for technical analysis & trading ProRealTime (10.3) to all countries where it operates. The latest version of the software enables the use of game pads as input devices and adds improved detailed reports, including performance charts. Traders can view and assess their weekly, monthly, quarterly or yearly performance. There are also enhancements to the quick access interface which has new order types added to it that were previously only available in the advanced interface. The list of new order types includes Stop with limit protection, One cancels the other, At market if touched, etc.