Interactive Brokers adds “snap to” orders to Mosaic Order Entry panel in TWS

“Snap to Midpoint” is one of the order types that can help platform users trade within the spread. Others are Adaptive Algo, Relative, Pegged-to-Midpoint, and Limit order.

Trader Workstation (TWS), the trading platform developed by Interactive Brokers Group, Inc. (NASDAQ:IBKR), has been enhanced lately, with the revamp of the artificial intelligence technology behind IBot being among the changes. However, the lineup of enhancements to the platform is not exhausted with IBot and the company has just announced some improvements with regard to availability of certain order types.

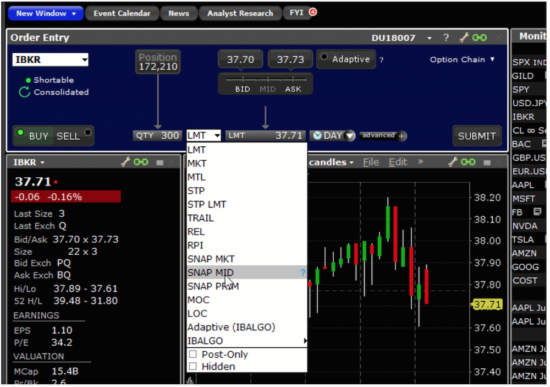

The latest Beta version of TWS increases the variety of orders in the Mosaic Order Entry panel thanks to the addition of several “snap to” order types. All “snap to” orders are similar to pegged orders, as the original order price is determined by the current bid/ask plus or minus an offset. Unlike the pegged order price, however, the “snap to” order price does not continue to peg as the price moves.

“Snap to Midpoint,” “Snap to Market” and “Snap to Primary” orders have now all been added to the Mosaic Order Entry panel.

Let’s take a look at the “Snap to Midpoint” order. To create such an order, the trader has to select SNAP MID as the order type and then to enter an offset amount which computes the active limit price as follows:

- Sell order price = Midpoint of the Bid/Ask price + offset amount;

- Buy order price = Midpoint of the Bid/Ask price – offset amount.

“Snap to Midpoint” is one of the order types that can help platform users trade within the spread. Other such order types are Adaptive Algo, Relative, Pegged-to-Midpoint, and Limit order.

FinanceFeeds has already informed its readers about Adaptive Algo. As its name suggests, it adjusts to market conditions. To make use of the Adaptive IB Algo in Mosaic’s Order Entry, one simply has to click on the Adaptive button – this will activate the Adaptive mode. Traders then may choose to set a specific limit price, which results in an Adaptive Limit order, or leave the “MARKET” price, which leads to an Adaptive Market order.

An Adaptive Market order dynamically selects and varies the price in order to fill at the best all-in price. An Adaptive Limit order uses the limit price as a price cap. The Adaptive Limit will only fill at the specified limit price or better.