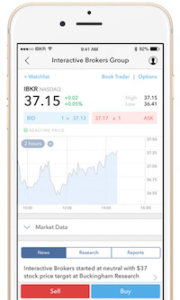

Interactive Brokers enhances options trading functionalities in IB TWS mobile app

The new version of the application for iOS devices introduces enhancements to options chains, easier order submission, as well as support for 3D Touch in Watchlist and Portfolio.

Electronic trading company Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just launched a new and updated version (8.32) of the IB TWS mobile app for iOS devices. The raft of enhancements concern options chains, order submission and 3D Touch support.

For starters, traders can now can load the details for an option from Option chains and then trade the option without first adding to the watchlist. Also, Greeks have been added to the option chains by scrolling the options list horizontally. Users can also add Greeks as columns in watchlists and portfolio.

The solution now features a slide to transmit button, which makes submitting an order possible as a single action. By the way, this feature can be turned off in the configuration by enabling “Simplified user interface”.

The solution now features a slide to transmit button, which makes submitting an order possible as a single action. By the way, this feature can be turned off in the configuration by enabling “Simplified user interface”.

The app now supports 3D Touch in Watchlist and Portfolio. If traders press lightly, they will get a peek at the current watchlist row. Swiping up will display Buy and Sell buttons if trading is enabled. Pressing harder enables traders to go to the details for the current row.On the home screen, a hard press shows quick actions to load the Portfolio or Account windows.

There are also some improvements to the dark color theme.

The mobile trading app IB TWS allows traders to monitor market activity and trade with real-time quotes, charts, and market scanners. Standard order types, as well as complex option spreads are supported.

Amid the latest important updates to the solution, we should mention that in November 2016, IBot became available as a feature in IB TWS. IBot is the text-based interface for the TWS platform – the AI solution has undergone rapid development since. The most recent enhancements to the functions of the bot including adding tickers to watchlists.

IBot responds to commands from different areas of interest to traders, varying from account information to charts and quotes. There are, of course, non-supported and misunderstood commands. If the traders enter a non-supported command, or one that IBot cannot accurately interpret, the bot will provide her best efforts result accompanied with a “Potentially misunderstood” warning message and an icon.