Investment product complaints comprise 2% of all complaints received by UK financial firms in H1 2018

Complaints about investment products continue to have the lowest rate of being upheld by firms, the FCA data shows.

Complaints about investment products account for meager 2% of all complaint volumes in the first half of 2018, according to data released today by the UK Financial Conduct Authority (FCA).

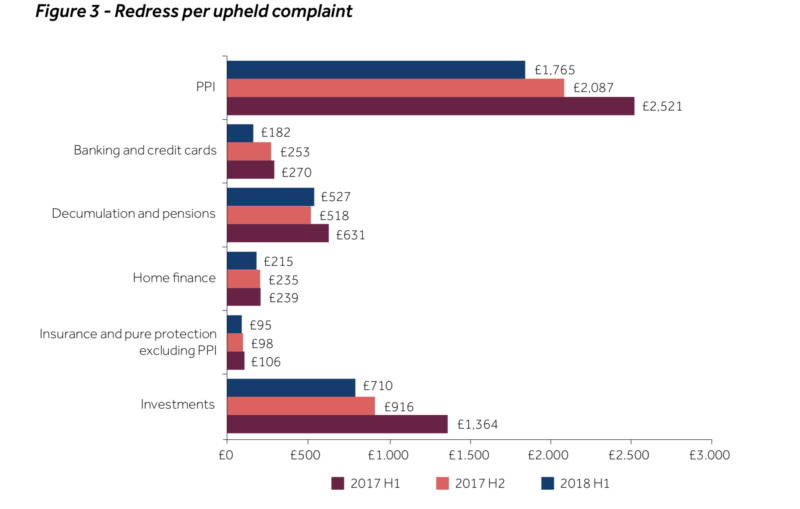

This, however, is not the single piece of data provided by the UK regulator in this respect. Thus, the numbers show that redress paid per upheld complaint in the first six months of 2018 has fallen most significantly from the second half of 2017 for investments, PPI and banking and credit cards. For investments, the redress fell from £916 in the second half of 2017 to £710 in the first half of 2018.

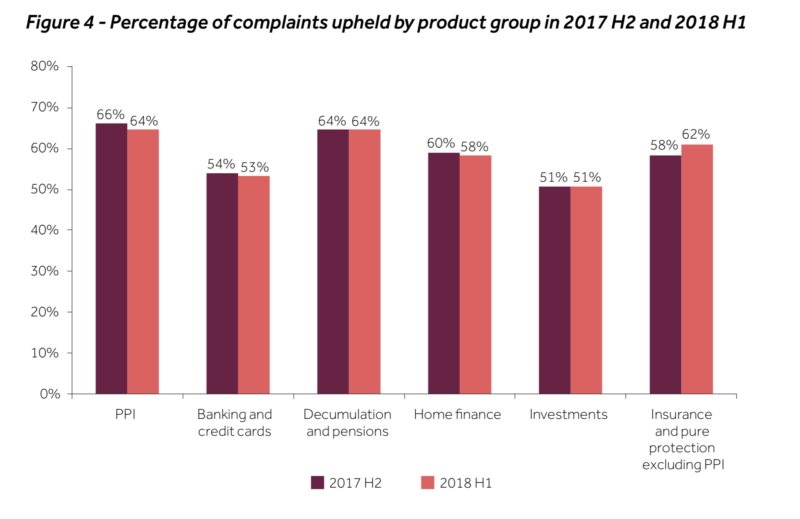

Adding to the gloomy data about investment product complaints, the numbers for the first six months of this year show that, at the product group level, complaints about investment products continue to have the lowest rate of being upheld by firms. Only 51% of complaints were upheld in both the second half of 2017 and the first half of 2018.

Overall, complaints continued to increase for the fourth successive half year, reaching a new record level. A total of 3,161 firms received 4.13 million complaints during the first half of 2018. This was a 10% (360,108) increase compared with the previous 6-month period (the second half of 2017), when 3.77 million complaints were received. 98% of the 4.13 million complaints were made to 235 firms, which received 500 or more complaints each.

Excluding Payments Protection Insurance (PPI), complaints increased by 9% (193,360) from the previous 6-month period.

Let’s recall that, a year ago, the FCA reported that 3,471 complaints concerning FX/CFD/Spreadbetting were opened in the first half of 2017. They accounted for 5% of the total number of complaints filed by clients of investment firms. The data provided by the FCA today did not include such details about investment product complaints.