MercerFX disappears: What happened to the management team, and the client funds?

UPDATE: FinanceFeeds received comment from Mr. Ashok Kumar refuting claims by MercerFX he purchased their “book”. Read the full investigation here. Retail FX brokerage Mercer FX has taken its website offline opting for a loading screen that has been coded and installed server side (no it’s not your connection). This comes three months after FinanceFeeds […]

UPDATE: FinanceFeeds received comment from Mr. Ashok Kumar refuting claims by MercerFX he purchased their “book”. Read the full investigation here.

Retail FX brokerage Mercer FX has taken its website offline opting for a loading screen that has been coded and installed server side (no it’s not your connection).

This comes three months after FinanceFeeds reported that the company had been the subject of a series of complaints to the New Zealand FMA containing allegations of fraudulent practices which date back to 2014.

FinanceFeeds contacted the company’s former CEO Jake Amar yesterday, who, when asked why the company’s site is down, stated “I have no idea actually, this is not related to me anymore.”

Mr. Amar continues to maintain that he sold the company to an individual who goes by the name of Ashok Ashok (pictured below, real name Matthew Ashok Kumar). However, it is more likely to be the former customers of the company that will get a shock or in this case maybe two shocks when they find that their attempts to obtain their funds from the company are looking increasingly slim.

Before allegedly purchasing Mercer FX, Mr. Ashok Kumar was known as Thomas, an FX trainer who held seminars in various regions in order to onboard IBs to Mercer FX. His parlance and style was a matter of force and bravado over function, and his delivery powerful yet lacking in technical detail.

Mercer FX continues to maintain that it sold the entire operations to Ashok Ashok, however a contract which details the transaction states that Mercer FX sold the client book for Asia, UK, Netherlands and New Zealand.

When this was pointed out, the company provided a statement to FinanceFeeds stating “As you can see, it is also mentioned there that all the managed accounts and EA users have now been transferred to Mr. Ashok Kumar.”

Mercer FX maintains that the net assets of the combined client list was $600,000, and that according to Mr. Amar, $400,000 was paid out to customers. “I guess the rest didn’t get anything” he said.

“Mr. Ashok Kumar killed the company” alleged Mr. Amar, “There are no regulations of course, and absolutely no recourse.”

So what is Mr. Amar’s new venture, and why you should exercise caution

Speaking to Mr. Amar yesterday, he claims that he is no longer in the FX industry, and has started a call center in the insurance business.

This does not tally with investigations made by FinanceFeeds which have led us to a new entity called IntegraFX which uses the website www.integrafx.com

FinanceFeeds conducted a detailed investigation within the industry and have found that Mr. Amar is indeed involved with integrafx.com alongside other executives from Mercer FX.

Interestingly, further investigations unveiled sources which understand that Mr. Amar is still involved with Mercer FX, and has simply started up a new website, and closed the previous one down. Some allege that it is unlikely that Mr. Ashok Kumar made any form of payment for any clients, and that the client book purchase contract probably has no value or standing.

A quick look at the website of integrafx.com shows that it is registered in the island of St Vincent, and the contact phone number is in Poland, however FinanceFeeds can confirm that the executive team are in fact based in Israel, and are common to the executive team of the formerly unregulated Mercer FX which has now vanished, giving very little recourse to clients.

Back in March, FinanceFeeds investigated and contacted one of the victims of the situation. Mr. Caleb Nathi opened and funded a managed account in 21 October 2015. Asking for a withdrawal since early March, the reply he got from the firm was similar to what was described in the Internal Affairs’ website:

“Mercer Capital is always looking to improve our systems, servers and trading environment. As such, we are moving our clients to our new faster server environment named Walton.”

Later that month, the company’s website mercerfx.com had been blocked to certain users in certain jurisdictions. FinanceFeeds was unable to find out if it was a move by the government or by Mercer Capital, since none of these entities replied to contacts. Other executive names are pegged to the Mercer Capital situation, already finding a place on youtube, and lawsuits are underway.

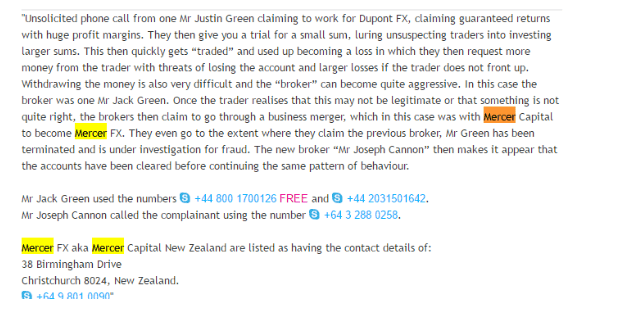

The Department of Internal Affairs in New Zealand recently published on its website a detailed report of how the company operated, recurrently making unsolicited phone calls “claiming guaranteed returns with huge profit margins. They then give you a trial for a small sum, luring unsuspecting traders into investing larger sums.

According to the New Zealand authorities, client monies then quickly got “traded” and used up becoming a loss in which they then request more money from the trader with threats of losing the account and larger losses if the trader does not front up.”

The statement added that withdrawing the money was also very difficult and the “broker” could become quite aggressive. But once the client suspected to be involved in illegitimate business, the broker then claimed that it was going through a business merger or that the previous account manager has been terminated and is under investigation for fraud. However, the same pattern of behavior continued regardless of any new manager.

Mr. Amar told FinanceFeeds that he was never in a senior capacity at Mercer FX (even though his title was CEO), and that he is now in the process of founding an insurance agency, with four staff, working as an intermediary to refer customers to insurance companies.

When asked what his involvement with IntegraFX is, he said “That is a company that I helped Yogev Ohayon (formerly employed by UTrade) to build up. I am not a director of Integra FX, and the two people founding it are no longer connected to Mercer FX.”

When asked if Mercer FX was still operating, Mr. Amar said “I have no idea if it is closed down or not. The phone number of Thomas (Ashok Kumar) is disconnected and I have not spoken to him for some time.”

Request for comment from Mr. Ashok (Kumar) have gone unanswered. FinanceFeeds will continue to try to reach Mr. Ashok over the coming days.