New version of CQG Desktop platform offers trading and charting enhancements

Version 4.9 of the platform provides traders with the ability to modify order duration on working orders, and offers algo orders support.

Provider of high-performance trading, market data, and technical analysis tools CQG has announced an update to its desktop platform. CQG Desktop Version 4.9 comes equipped with a raft of enhancements concerning trading and charting.

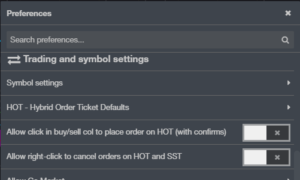

There are improvements concerning HOT. When traders click in the Buy/Sell columns they can place orders in the HOT. To do that, go to Preferences > Trading and symbol settings > Allow click in buy/sell col to place order on HOT (with confirms).

Click in the Buy/Sell columns next to the desired price in the price scale;

Click in the Buy/Sell columns next to the desired price in the price scale;- Click in the lower half of the cell to place an additional order at that price;

- Double-click on the order in the buy/sell column to see Order Info and modify or cancel.

Traders gain the ability to modify order duration on working orders. That is, duration can now be changed in the Modify order dialog.

The platform also offers algo orders support.

Further, the Fill report has become accessible from the navigation bar. Traders can access Fill Report when fill notifications are off, as the Fill Report popup is now available from the left bar for when fill notifications not enabled in preferences. An alert indicator will appear on the Fill Report icon when fills occur. Click on the Fill Report icon to open the popup to see fill information.

Further, the Fill report has become accessible from the navigation bar. Traders can access Fill Report when fill notifications are off, as the Fill Report popup is now available from the left bar for when fill notifications not enabled in preferences. An alert indicator will appear on the Fill Report icon when fills occur. Click on the Fill Report icon to open the popup to see fill information.

In terms of charting, let’s note that the platform has added weighted calculation for Moving Average study. DMI with ADX study was also added.

Finally, the platform now offers Bollinger Bands % study.

The previous version (4.8) of the solution makes enhancements to the Contract Specifications (CSPEC) widget, which provides detailed contract information for products in the futures, cash, currencies, indices, government reports, stocks, and fixed income markets. Maintenance margin has been added to the CSPEC widget as well as an MIC label to exchange to help with troubleshooting.

Version 4.7 of the platform included enhancements to quotes and charting. For instance, traders got the ability to sort a QSS (Quote SpreadSheet) and SST by symbol. Like any of the other columns in QSS/SST, clicking on the column header will sort by that column. It is a 3-state toggle, so clicking on the column will toggle between ascending, descending, then back to manual sort.

Click in the Buy/Sell columns next to the desired price in the price scale;

Click in the Buy/Sell columns next to the desired price in the price scale;