TD Ameritrade mobile app gets equipped with new Dashboard

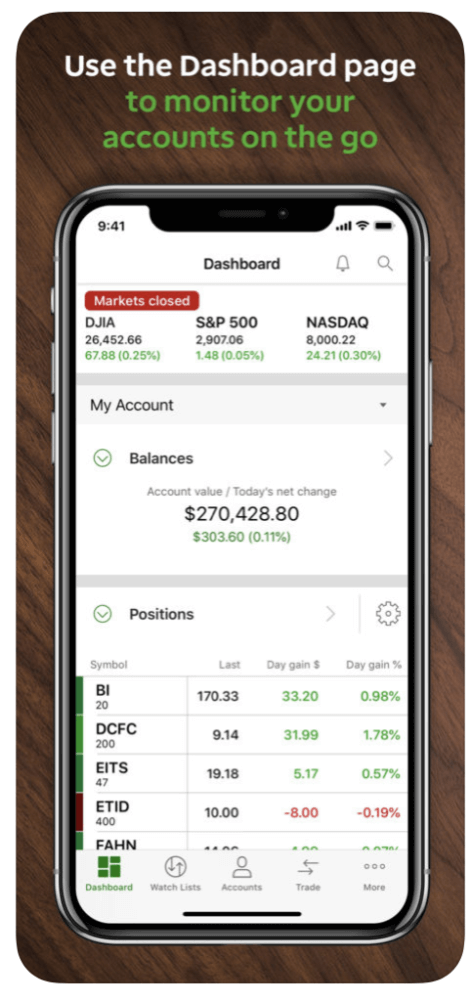

Version 6.0.0 of TD Ameritrade mobile app for iPhone introduces a new landing screen with quick access to essential information.

TD Ameritrade has recently launched a new version (6.0.0) of its mobile app. The updated solution introduces Dashboard (on iPhone only) – a new landing screen with quick access to essential information.

Users of the TD Ameritrade mobile app can see account and markets info in easy-to-browse modules. They can also access the Markets screen from the redesigned More menu.

TD Ameritrade has been regularly updating its mobile solutions. In April this year, TD Ameritrade mobile app introduced a new Markets page. The Research overview tab was moved to the new and improved Markets page, which offers a clean look and feel and features enhanced charts with streaming data.

In one of the preceding releases of the app, TD Ameritrade enabled traders to customize their watchlists. For instance, they can display more than 45 new data points. Furthermore, traders get to place data columns in any order they’d like and to sort data columns by tapping the column headers. Traders can also view data definitions and add up to 300 symbols. One can switch back to the standard watch list view any time with one tap.

The mobile solution allows traders to keep up on the market with price alerts, real-time streaming quotes, helpful charts, Level II quotes, News, and the Today widget. Traders can track and trade stocks, options (up to two-leg strategies), options chains, and exchange-traded funds (ETFs), and check their order status when on the go.

Traders can also transfer funds to and from their account, and use mobile check deposit to deposit funds. The app allows the use of Face ID or Touch ID for signing in and for authorizing trades and transfers.

Users of the app can take advantage of educational offerings and browse videos on investing strategies, stocks, and options. Traders can also access third-party research like on-demand video from Thomson Reuters and CNBC, plus stay up to date with the latest analyst reports, Social Signals, and Twitter integration.

Alerts are available so that traders can spot potential trading opportunities, get notifications when certain price targets are met, and stay up to date when key news breaks or events occur.