Global Brokerage registers total stockholder deficit of $72.36m in Q3 2018

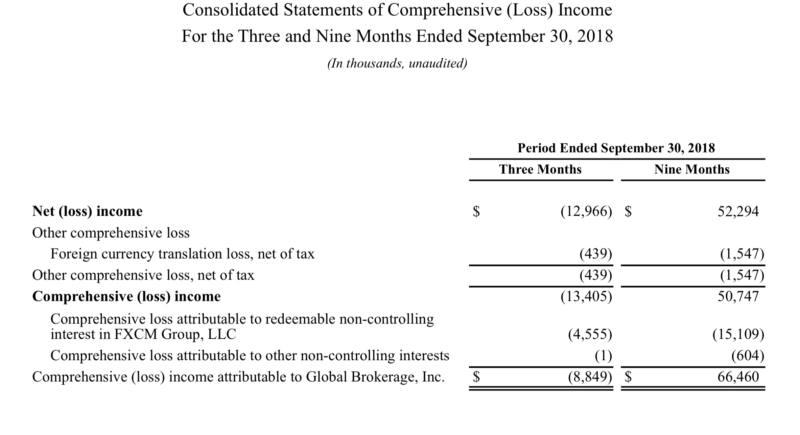

The company reported a net loss of $12.97 million for the three months to September 30, 2018.

Global Brokerage Inc (OTCMKTS:GLBR), formerly known as FXCM Inc, has posted a set of metrics for the third quarter of 2018. The company, whose Chapter 11 case was closed this summer, saw its stockholders’ deficit widen further in the three months to September 30, 2018, and reported a net loss for the period.

Those of FinanceFeeds’ readers who have been monitoring the recent financial reports by Global Brokerage are probably aware that these lack the details we are used to see in a SEC filing or the press releases FXCM Inc used to post. The report for the third quarter of 2018 contains the main financial metrics one would expect to see in a quarterly report but does not offer any explanation for the numbers.

Let’s note the basics. Global Brokerage registered a net loss of $12.97 million for the three months to end-September 2018. This compares to a net loss of $16.55 million registered in the second quarter of 2018.

The stockholders’ deficit grew compared to the preceding quarter. It exceeded $72.36 million at the end of the third quarter of 2018.

During the quarter, Drew Niv and Global Brokerage had a case against them dismissed in New York. In August, Judge Kimba M. Wood of the New York Southern District Court ruled in favor of the defendants in a lawsuit concerning the events around January 15, 2015.

The plaintiff – Retirement Board of the Policemen’s Annuity and Benefit Fund of Chicago, acting on behalf of the Policemen’s Annuity and Benefit Fund of Chicago, had brought this putative securities class action against FXCM Inc. (“FXCM”) and Dror Niv. The plaintiff alleged that FXCM and Niv had made material misstatements and omissions concerning risks in FXCM’s business. The defendants have moved to dismiss the plaintiff’s Second Amended Complaint for failing to adequately allege (i) that Defendants made a materially false statement, (ii) that Defendants acted with scienter, and (iii) loss causation.

The Judge granted the defendants’ motion to dismiss because the plaintiff had failed to adequately allege that FXCM Inc and Niv made material misrepresentations or omissions and acted with scienter.