SEC v. Ripple: What’s next on the XRP lawsuit agenda?

The trials and tribulations of the XRP community and the digital asset ecosystem.

The SEC v. Ripple lawsuit has been dragging in the eyes of many executives and investors within the trading industry, particularly the digital asset space, leaving many questioning “why is the lawsuit taking so long?” and “when will the lawsuit end?“.

Many legal experts, on the other hand, have said time and again that the SEC v. Ripple is unlikely to have an ending this year, although anything can happen as a settlement deal could go down at any time.

In late July, a series of “strange things” led attorney Jeremy Hogan to speculate that both parties had reached a deal. That wasn’t the case, but it goes to show that a settlement this year can’t be ruled out entirely.

So what’s next in the “cryptocurrency trial of the century”?

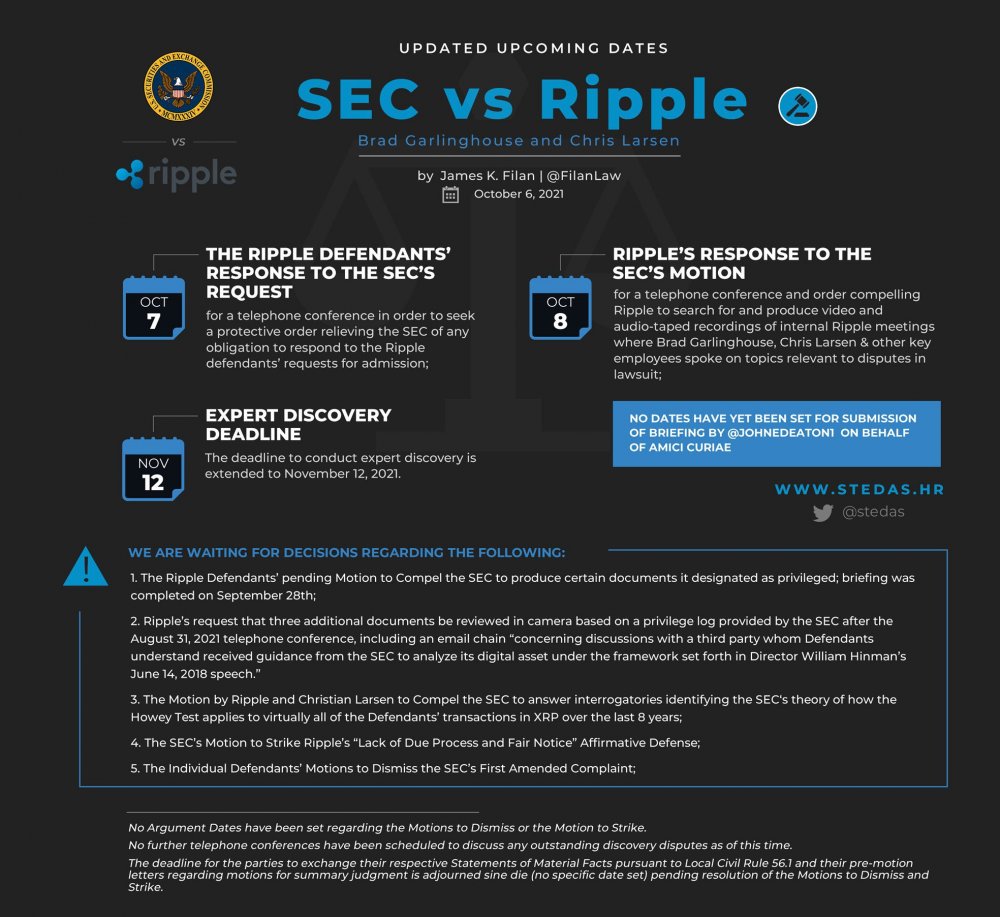

As to the lawsuit agenda, attorney James K. Filan shared an updated lawsuit agenda with design by XRP community member @stedas, which can be found below.

October 7: Ripple is expected to respond to the SEC’s request for a protective order relieving the SEC to answer nearly 30,000 requests for admission.

October 8: Ripple is due to respond to the SEC’s intention to compel the production of video and audio-taped recordings relevant to the case. The SEC complained that Ripple performed a “flawed search”.

September 28?: The lawsuit’s most popular telephone conference, relating to the SEC’s claim of deliberative process privilege for its internal documents, resulted in the Judge ordering an in-camera review with her ruling on the matter coming in no earlier than September 28.

Ripple has recently filed a revised response to the SEC’s brief regarding the allegedly privileged documents with a revamped attitude arguing that if the SEC’s deliberations are only personal opinions from the agency’s officials then those documents can’t be privileged information in the eyes of the law.

The Defendants also asked the Court to add three documents to her in-camera review as their Counsel team found that the SEC was withholding hidden information that could prove Hinman’s 2018 was official policy and not a personal opinion.

No date on XRP Holders: They have scored a major win by being granted the “Amicus Curiae” status despite seeing its motion to intervene denied. This will allow John Deaton and five other individuals to submit briefs to the court, but no date has been set.

No date on Howie: The Court is due to schedule a date to further discuss Ripple’s motion to compel the SEC to answer its interrogatories on how the Howie Test applies to all XRP transactions over the past eight years.

No date on motion to strike Fair Notice defense: The SEC filed the motion on the grounds that a Ripple win would nullify the Howie Test.

No date on Garlinghouse and Larsen’s motion to dismiss: The individual defendants requested the dismissal of the SEC’s first amended complaint.

November 12: In late August, the Court updated the agenda to extend fact discovery to accommodate the depositions of Brad Garlinghouse and Chris Larsen. The deadline for expert discovery has been extended to November 12.

There’s more on Ripple:

- Ripple lawsuit raises hopes as ‘Crypto Mom’ condemns SEC policy

- SEC v. Ripple: XRP Holders score “huge win” with Amicus Curiae status

- SEC pushes back against Ripple’s “flawed search” of evidence on XRP

- Ripple running out of time as BIS ‘conspires’ to end cryptos’ threat to financial system

- SEC v. Ripple: XRP’s utility and currency value backed by former U.S. Treasurer

- Ripple pushes SEC up against the wall: “If personal opinions, then no privilege”

- Ripple buries SEC in paperwork in XRP lawsuit: Nearly 30,000 requests

- Ripple responds to Senator Toomey on XRP, the SEC, and how to do better